Question: A very wealthy client contacts you to discuss purchasing a potential investment property. He has already prepared a cash flow model and has provided it

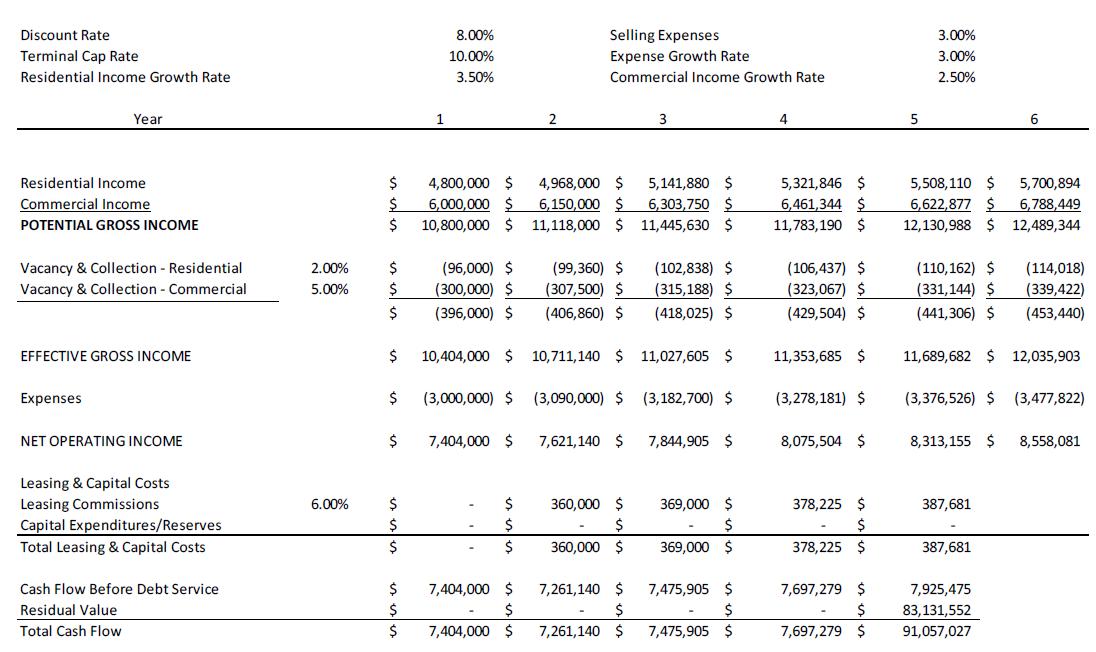

A very wealthy client contacts you to discuss purchasing a potential investment property. He has already prepared a cash flow model and has provided it to you for review. The property is stabilized, mixed use building with residential and commercial tenants. The project is located in a very stable area with a solid list of tenants. Though the project was built within the last 5 years, there are some signs of deferred maintenance and a need for $100,000 in capital expenditures right away. Commercial leasing commissions are 6.00% and begin in Year 2. Leasing commissions are calculated based on the prior year’s rent.

Your client intends on purchasing the property for $70,000,000 all cash and will sell it in Year 5. His Discount Rate is 8.00%. He believes the project will generate a NPV of $15,412,074 and an IRR of 13.60%.

THIS IS ALL INFO PROVIDED

1. After reviewing the model, what concerns (if any) do you have?

2. After making any necessary changes to the model, explain if your client should invest or not.

3. Your client increases his bid to $90,000,000. Should he invest? Why or why not?

Discount Rate Terminal Cap Rate Residential Income Growth Rate Year Residential Income Commercial Income POTENTIAL GROSS INCOME Vacancy & Collection - Residential Vacancy & Collection - Commercial EFFECTIVE GROSS INCOME Expenses NET OPERATING INCOME Leasing & Capital Costs Leasing Commissions Capital Expenditures/Reserves Total Leasing & Capital Costs Cash Flow Before Debt Service Residual Value Total Cash Flow 2.00% 5.00% 6.00% $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 1 8.00% 10.00% 3.50% 4,800,000 $ 6,000,000 $ 10,800,000 $ (96,000) $ (300,000) $ (396,000) $ 10,404,000 $ (3,000,000) $ 7,404,000 $ $ $ $ 7,404,000 $ $ 7,404,000 $ 2 Selling Expenses Expense Growth Rate Commercial Income Growth Rate 4,968,000 $ 6,150,000 $ 11,118,000 $ (99,360) $ (307,500) $ (406,860) $ (3,090,000) $ 7,621,140 $ 10,711,140 $ 11,027,605 $ 360,000 $ $ 360,000 $ 3 7,261,140 $ $ 7,261,140 $ 5,141,880 $ 6,303,750 $ 11,445,630 $ (102,838) $ (315,188) $ (418,025) $ (3,182,700) $ 7,844,905 $ 369,000 $ $ 369,000 $ 7,475,905 $ $ 7,475,905 $ 4 5,321,846 $ 6,461,344 $ 11,783,190 $ (106,437) $ (323,067) $ (429,504) $ 11,353,685 $ (3,278,181) $ 8,075,504 $ 378,225 $ $ 378,225 $ 7,697,279 $ $ 7,697,279 $ 5 3.00% 3.00% 2.50% 5,508,110 $ 5,700,894 6,622,877 $ 6,788,449 12,130,988 $ 12,489,344 (110,162) $ (331,144) $ (441,306) $ 11,689,682 $ (3,376,526) $ 8,313,155 $ 387,681 6 387,681 7,925,475 83,131,552 91,057,027 (114,018) (339,422) (453,440) 12,035,903 (3,477,822) 8,558,081

Step by Step Solution

There are 3 Steps involved in it

Answer Step 1 Step 2 Step 3 The question has alread... View full answer

Get step-by-step solutions from verified subject matter experts