Question: A . Volatility is an important input in option valuation, but it is not an observed variable and must be estimated. It can be estimated

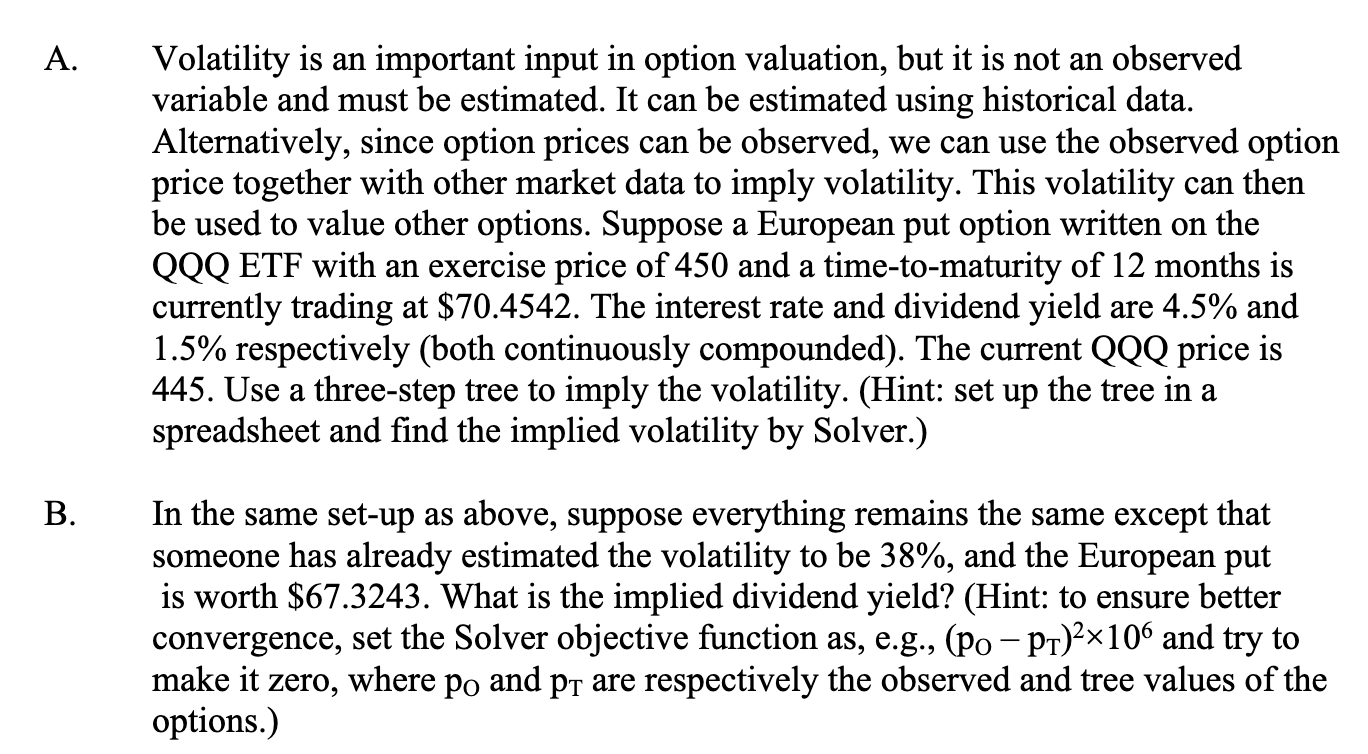

A Volatility is an important input in option valuation, but it is not an observed

variable and must be estimated. It can be estimated using historical data.

Alternatively, since option prices can be observed, we can use the observed option

price together with other market data to imply volatility. This volatility can then

be used to value other options. Suppose a European put option written on the

QQQ ETF with an exercise price of and a timetomaturity of months is

currently trading at $ The interest rate and dividend yield are and

respectively both continuously compounded The current QQQ price is

Use a threestep tree to imply the volatility. Hint: set up the tree in a

spreadsheet and find the implied volatility by Solver.

B In the same setup as above, suppose everything remains the same except that

someone has already estimated the volatility to be and the European put

is worth $ What is the implied dividend yield? Hint: to ensure better

convergence, set the Solver objective function as eg and try to

make it zero, where and are respectively the observed and tree values of the

options.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock