Question: A. What amount of gain or loss does 8MH recognize in the complete liquidation? (Negative amount should be indicated by a minus sign. Leave no

A. What amount of gain or loss does 8MH recognize in the complete liquidation? (Negative amount should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable.)

A. What amount of gain or loss does 8MH recognize in the complete liquidation? (Negative amount should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable.)

B. What amount of gain or loss does JMI recognize in the complete liquidation? (Negative amount should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable.)

C. What is JMIs tax basis in the building and land after the complete liquidation?

TAX BASIS BUILDING LAND

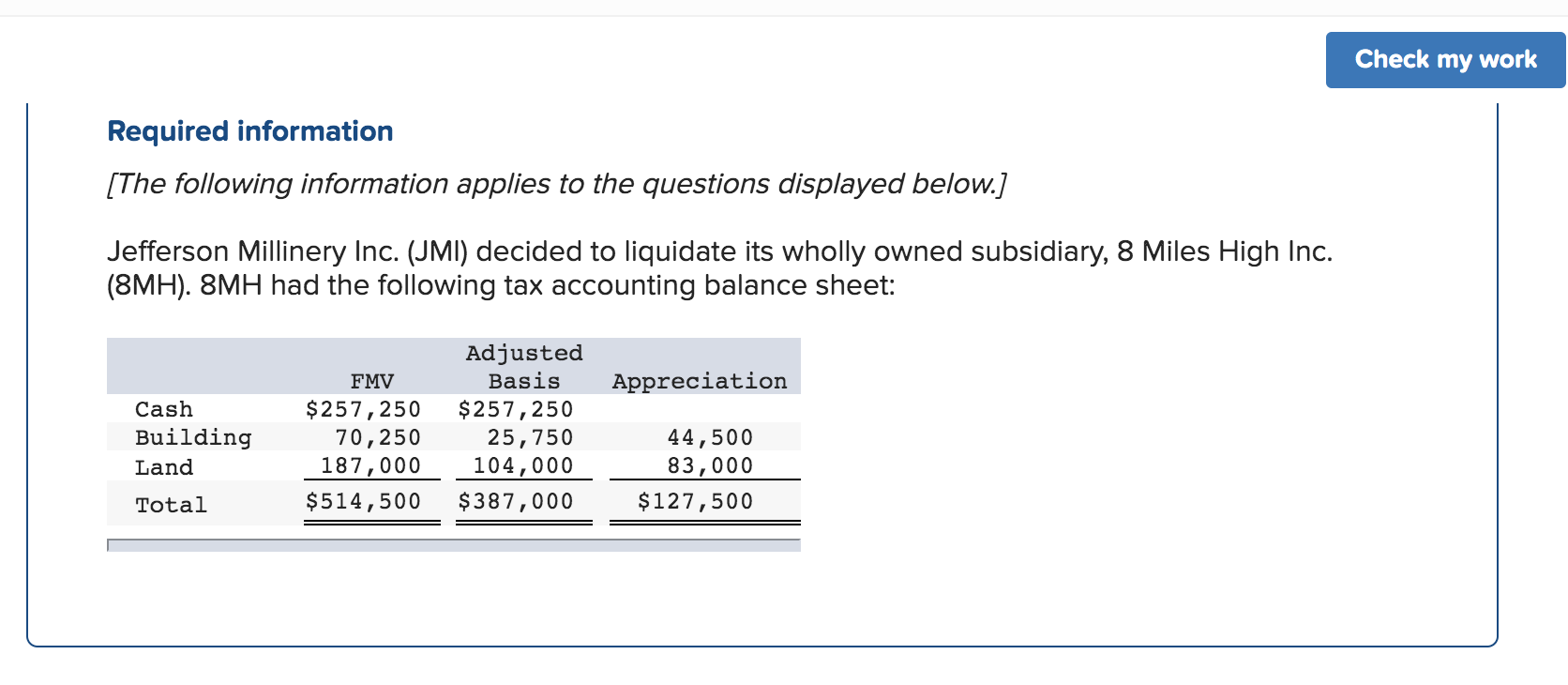

Check my work Required information [The following information applies to the questions displayed below.] Jefferson Millinery Inc. (JMI) decided to liquidate its wholly owned subsidiary, 8 Miles High Inc. (8MH). 8MH had the following tax accounting balance sheet: Appreciation Cash Building Land FMV $257,250 70,250 187,000 $514,500 Adjusted Basis $257,250 25,750 104,000 $387,000 44,500 83,000 $127,500 Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts