Question: A) What amount should be transferred from Work in Process Inventory to Finished Goods Inventory? B) Was manufacturing overhead OVER or UNDER applied during the

A) What amount should be transferred from Work in Process Inventory to Finished Goods Inventory?

B) Was manufacturing overhead OVER or UNDER applied during the month and by how much?

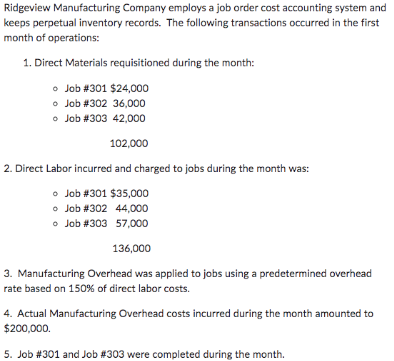

Ridgeview Manufacturing Company employs a job order cost accounting system and keeps perpetual inventory records. The following transactions occurred in the first month of operations: 1. Direct Materials requisitioned during the month: - Job \#301 $24,000 - Job \#302 36,000 - Job \#303 42,000 102,000 2. Direct Labor incurred and charged to jobs during the month was: - Job #301$35,000 - Job \#302 44,000 - Job \#303 57,000 136,000 3. Manufacturing Overhead was applied to jobs using a predetermined overhead rate based on 150% of direct labor costs. 4. Actual Manufacturing Overhead costs incurred during the month amounted to $200,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts