Question: a. What are the arithmetic and geometric average time-weighted rates of return for the investor? (Do not round intermediate calculations. Round your answers to 2

a. What are the arithmetic and geometric average time-weighted rates of return for the investor? (Do not round intermediate calculations. Round your answers to 2 decimal places.)

b-1. Prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2018, to January 1, 2021. (Negative amounts should be indicated by a minus sign.)

b-2. What is the dollar-weighted rate of return? (Hint: If your calculator cannot calculate internal rate of return, you will have to use a spreadsheet or trial and error.)(Negative value should be indicated by a minus sign. Round your answer to 4 decimal places.)

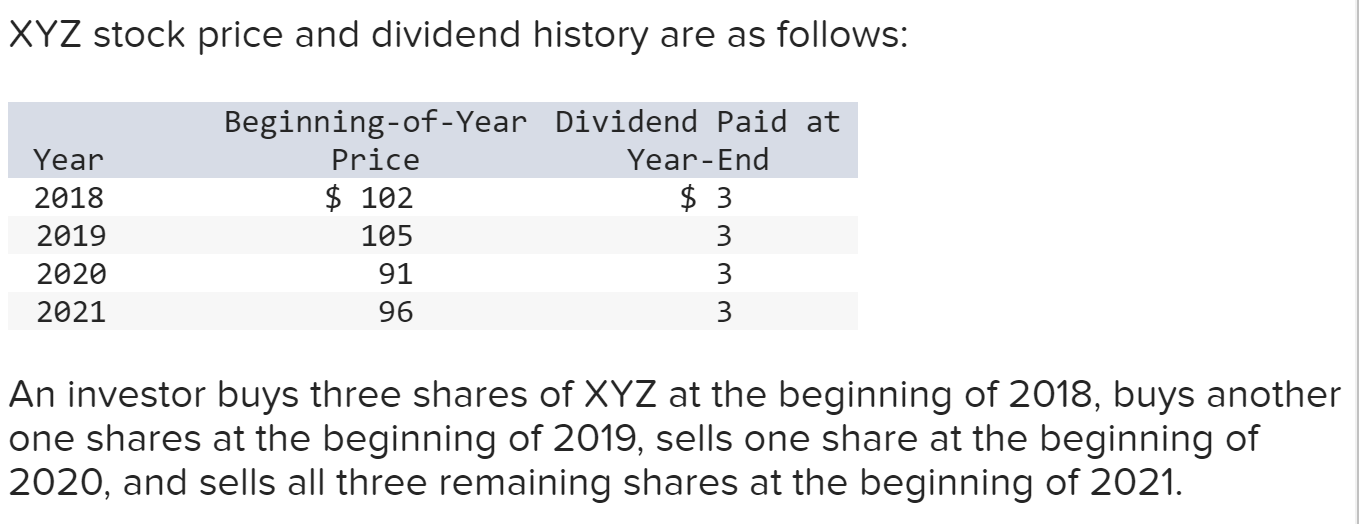

XYZ stock price and dividend history are as follows: An investor buys three shares of XYZ at the beginning of 2018 , buys another one shares at the beginning of 2019 , sells one share at the beginning of 2020 , and sells all three remaining shares at the beginning of 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts