Question: A. What decision should be made using the Expected Opportunity Loss (EOL) decision rule? B. What is the Expected Value of Perfect Information (EVPI)? C.

A. What decision should be made using the Expected Opportunity Loss (EOL) decision rule?

B. What is the Expected Value of Perfect Information (EVPI)?

C. What decision should be made according to the Expected Monetary Value (EMV) decision rule?

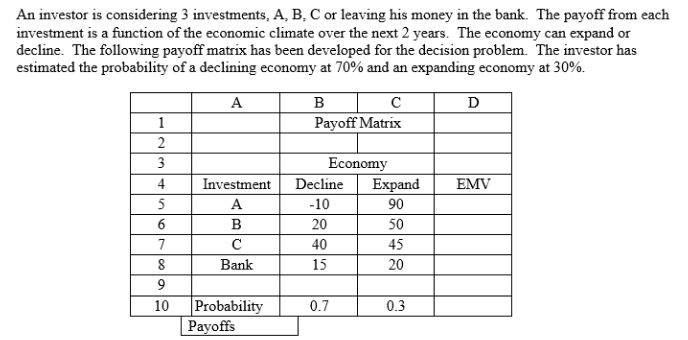

An investor is considering 3 investments, A, B, C or leaving his money in the bank. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem. The investor has estimated the probability of a declining economy at 70% and an expanding economy at 30%. A D B Payoff Matrix EMV 1 2 3 4 5 6 7 8 9 10 Investment A B Bank Economy Decline Expand -10 90 20 50 40 45 15 20 0.7 0.3 Probability PayoffsStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts