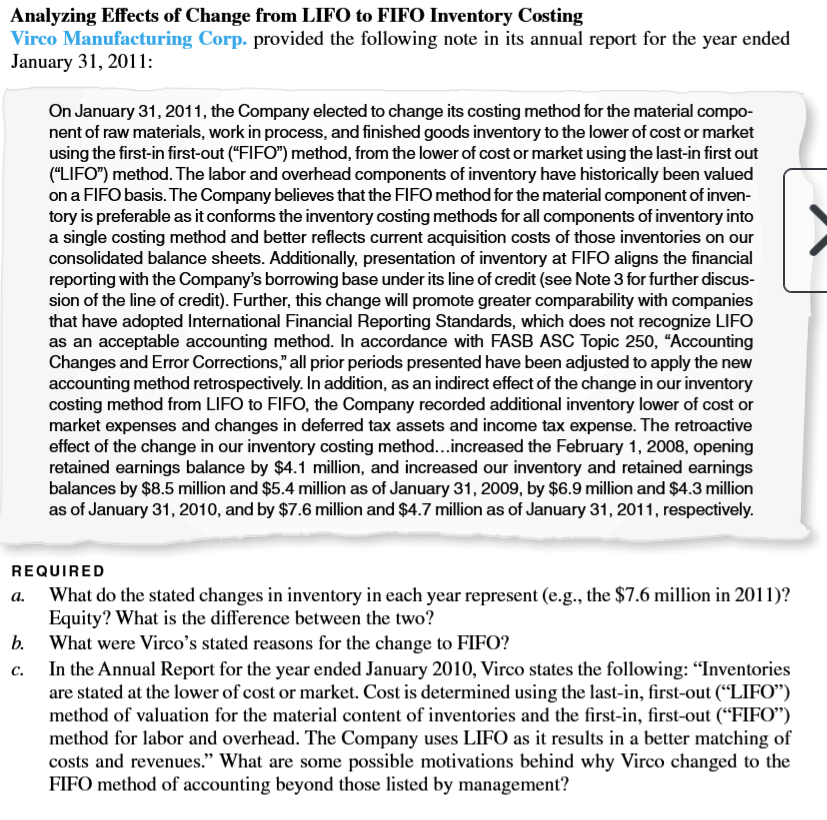

Question: a . What do the stated changes in inventory in each year represent ( e . g . , the $ 7 . 6 million

a What do the stated changes in inventory in each year represent eg the $ million in Equity? What is the difference between the two?

b What were Virco's stated reasons for the change to FIFO?

c In the Annual Report for the year ended January Virco states the following: "Inventories are stated at the lower of cost or market. Cost is determined using the lastin firstout LIFO method of valuation for the material content of inventories and the firstin firstout FIFO method for labor and overhead. The Company uses LIFO as it results in a better matching of costs and revenues." What are some possible motivations behind why Virco changed to the FIFO method of accounting beyond those listed by management?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock