Question: (a) What do we mean by the term minimum required return and how can it be used by an investor to assess an equity security?

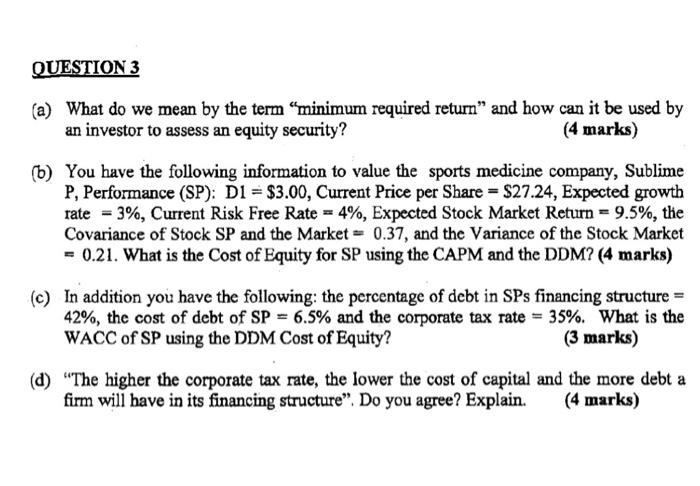

(a) What do we mean by the term "minimum required return" and how can it be used by an investor to assess an equity security? (4 marks) (b) You have the following information to value the sports medicine company, Sublime P, Performance (SP) : D1 =$3.00, Current Price per Share =$27.24, Expected growth rate =3%, Current Risk Free Rate =4%, Expected Stock Market Return =9.5%, the Covariance of Stock SP and the Market =0.37, and the Variance of the Stock Market =0.21. What is the Cost of Equity for SP using the CAPM and the DDM? (4 marks) (c) In addition you have the following: the percentage of debt in SPs financing structure = 42%, the cost of debt of SP =6.5% and the corporate tax rate =35%. What is the WACC of SP using the DDM Cost of Equity? (3 marks) (d) "The higher the corporate tax rate, the lower the cost of capital and the more debt a firm will have in its financing structure". Do you agree? Explain. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts