Question: A. What does the Internal Rate of Return evaluate? How should the percentage value that the IRR calculation provides be interpreted? B. Calculate the

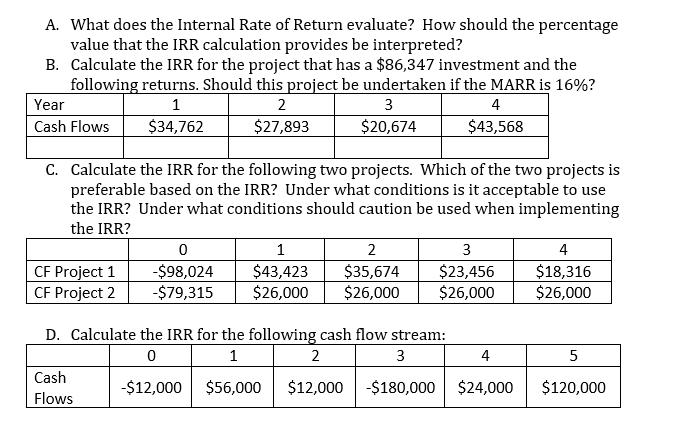

A. What does the Internal Rate of Return evaluate? How should the percentage value that the IRR calculation provides be interpreted? B. Calculate the IRR for the project that has a $86,347 investment and the following returns. Should this project be undertaken if the MARR is 16%? Year 1 Cash Flows $34,762 2 $27,893 3 $20,674 4 $43,568 C. Calculate the IRR for the following two projects. Which of the two projects is preferable based on the IRR? Under what conditions is it acceptable to use the IRR? Under what conditions should caution be used when implementing the IRR? 0 1 2 3 4 CF Project 1 -$98,024 $43,423 $35,674 $23,456 $18,316 CF Project 2 -$79,315 $26,000 $26,000 $26,000 $26,000 D. Calculate the IRR for the following cash flow stream: Cash Flows 0 1 2 3 4 5 $120,000 -$12,000 $56,000 $12,000 $180,000 $24,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts