Question: a . What does the term compounding mean? b . Let's say you want to know how much money you will have accumulated in your

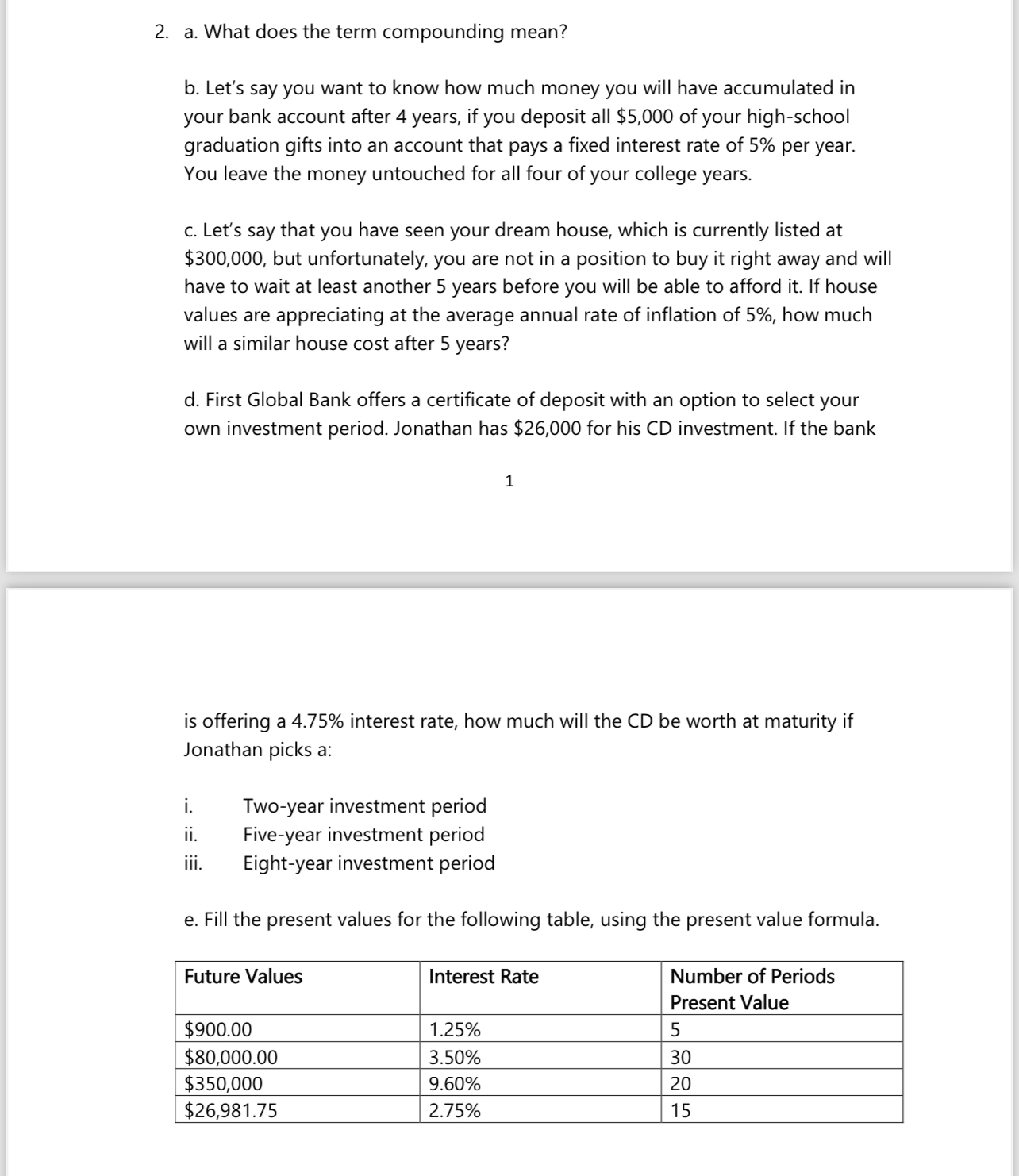

a What does the term compounding mean?

b Let's say you want to know how much money you will have accumulated in your bank account after years, if you deposit all $ of your highschool graduation gifts into an account that pays a fixed interest rate of per year. You leave the money untouched for all four of your college years.

c Let's say that you have seen your dream house, which is currently listed at $ but unfortunately, you are not in a position to buy it right away and will have to wait at least another years before you will be able to afford it If house values are appreciating at the average annual rate of inflation of how much will a similar house cost after years?

d First Global Bank offers a certificate of deposit with an option to select your own investment period. Jonathan has $ for his investment. If the bank

is offering a interest rate, how much will the CD be worth at maturity if Jonathan picks a:

i Twoyear investment period

ii Fiveyear investment period

iii. Eightyear investment period

e Fill the present values for the following table, using the present value formula.

tableFuture Values,Interest Rate,tableNumber of PeriodsPresent Value$$$$

a What does the term compounding mean?

b Let's say you want to know how much money you will have accumulated in your bank account after years, if you deposit all $ of your highschool graduation gifts into an account that pays a fixed interest rate of per year. You leave the money untouched for all four of your college years.

c Let's say that you have seen your dream house, which is currently listed at $ but unfortunately, you are not in a position to buy it right away and will have to wait at least another years before you will be able to afford it If house values are appreciating at the average annual rate of inflation of how much will a similar house cost after years?

d First Global Bank offers a certificate of deposit with an option to select your own investment period. Jonathan has $ for his investment. If the bank

is offering a interest rate, how much will the CD be worth at maturity if Jonathan picks a:

i Twoyear investment period

ii Fiveyear investment period

iii. Eightyear investment period

e Fill the present values for the following table, using the present value formula.

tableFuture Values,Interest Rate,tableNumber of PeriodsPresent Value$$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock