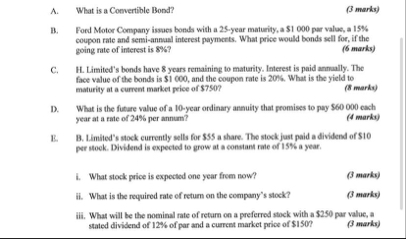

Question: A . What is a Convertible Bond? ( 3 marks ) B . Foed Motor Company issues bonds with a 2 5 - year maturity,

A What is a Convertible Bond?

marks

B Foed Motor Company issues bonds with a year maturity, a $ par value, a coupon rate and semiannual interest paymerts. What price would bonds sell for, if the going rate of interest is

marks

C H Limited's bonds have years remaining to maturity. Interest is paid annally. The face value of the bonds is $ and the coupon rate is What is the yield to maturity at a current market price of $

marks

D What is the futare value of a year ordinary annuity that promises to pay $cach year at a raic of per annum?

marky

E B Limited's stock currently sells for $ a share. The stock just paid a dividend of $ per stoek. Dividend is expected to grow at a constant rate of a year.

i What stock price is expected one year frem now?

marks

ii What is the required rate of retum on the company's stock?

marks

iii. What will be the nominal rate of return on a preferred stock with a $ par value, a stated dividend of of par and a current market price of $

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock