Question: a) What is each projects IRR? b) If each projects cost of capital were 10%, which project, if either, should be selected? If the cost

a) What is each projects IRR?

b) If each projects cost of capital were 10%, which project, if either, should be selected? If the cost of capital were 17%, what would be the proper choice?

c) What is each projects MIRR at the cost of capital of 10%? At 17%? (Hint: Consider Period 7 as the end of Project Bs life.)

d) What is the crossover rate, and what is its significance?

Please show all equations and answers in Excel format.

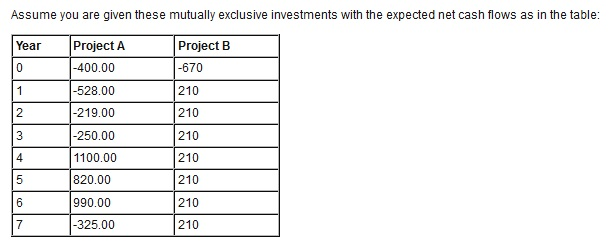

Assume you are given these mutually exclusive investments with the expected net cash flows as in the table Year Project A -400.00 528.00 219.00 250.00 1100.00 820.00 990.00 325.00 Project B -670 210 210 210 210 210 210 210 2 4 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts