Question: a) What is subaggregation clause in sovereign debt restructuring? b) Why does uniform applicability requirement not guarantee the same economic effect for all series of

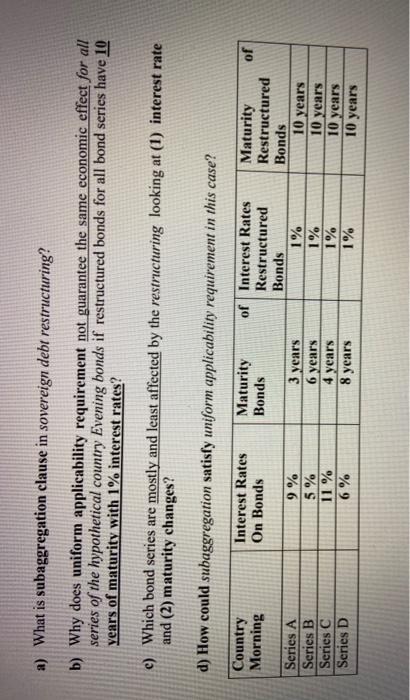

a) What is subaggregation clause in sovereign debt restructuring? b) Why does uniform applicability requirement not guarantee the same economic effect for all series of the hypothetical country Evening bonds if restructured bonds for all bond series have 10 years of maturity with 1% interest rates? c) Which bond series are mostly and least affected by the restructuring looking at (1) interest rate and (2) maturity changes? d) How could subaggregation satisfy uniform applicability requirement in this case? Country Morning Interest Rates On Bonds Maturity Bonds of Series A Series B Series C Series D 9% 5% 11 % 6 % 3 years 6 years 4 years 8 years of Interest Rates Restructured Bonds 1% 1% 1% 1% Maturity Restructured Bonds 10 years 10 years 10 years 10 years a) What is subaggregation clause in sovereign debt restructuring? b) Why does uniform applicability requirement not guarantee the same economic effect for all series of the hypothetical country Evening bonds if restructured bonds for all bond series have 10 years of maturity with 1% interest rates? c) Which bond series are mostly and least affected by the restructuring looking at (1) interest rate and (2) maturity changes? d) How could subaggregation satisfy uniform applicability requirement in this case? Country Morning Interest Rates On Bonds Maturity Bonds of Series A Series B Series C Series D 9% 5% 11 % 6 % 3 years 6 years 4 years 8 years of Interest Rates Restructured Bonds 1% 1% 1% 1% Maturity Restructured Bonds 10 years 10 years 10 years 10 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts