Question: a) What is the amount that would be shown for Goodwill in the consolidated financial statements at time of purchase? b) What is the amount

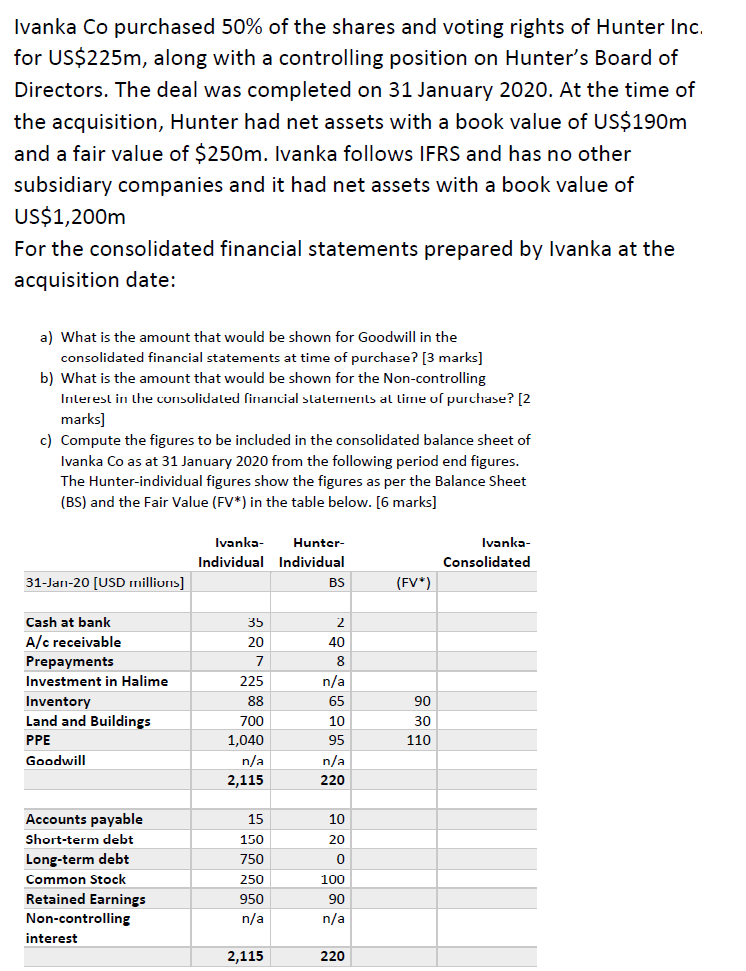

a) What is the amount that would be shown for Goodwill in the consolidated financial statements at time of purchase? b) What is the amount that would be shown for the Non-controlling Interest in the consolidated financial statements at time of purchase? c) Compute the figures to be included in the consolidated balance sheet of Ivanka Co as at 31 January 2020 from the following period end figures. The Hunter-individual figures show the figures as per the Balance Sheet (BS) and the Fair Value (FV*) in the table below.

Ivanka Co purchased 50% of the shares and voting rights of Hunter Inc. for US$225m, along with a controlling position on Hunter's Board of Directors. The deal was completed on 31 January 2020. At the time of the acquisition, Hunter had net assets with a book value of US$190m and a fair value of $250m. Ivanka follows IFRS and has no other subsidiary companies and it had net assets with a book value of US$1,200m For the consolidated financial statements prepared by Ivanka at the acquisition date: a) What is the amount that would be shown for Goodwill in the consolidated financial statements at time of purchase? [3 marks) b) What is the amount that would be shown for the Non-controlling Interest in the consolidaled financial statements al lime of purchase? (2 marks] c) Compute the figures to be included in the consolidated balance sheet of Ivanka Co as at 31 January 2020 from the following period end figures. The Hunter-individual figures show the figures as per the Balance Sheet (BS) and the Fair Value (FV*) in the table below. [6 marks] Ivanka Hunter- Individual Individual BS Ivanka- Consolidated 31-Jan-20 [USD millions] (FV*) Cash at bank A/c receivable Prepayments Investment in Halime Inventory Land and Buildings PPE Goodwill 35 20 7 225 88 700 2 40 8 n/a 65 10 95 n/a 220 90 30 110 1,040 n/a 2,115 10 20 0 Accounts payable Short-term debt Long-term debt Common Stock Retained Earnings Non-controlling interest 15 150 750 250 950 n/a 100 90 n/a 2,115 220

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts