Question: a) What is the CFo (initial outlay) for this project? (without excel) b) What is the terminal cash flow associated with this project? (without excel)

a) What is the CFo (initial outlay) for this project? (without excel)

a) What is the CFo (initial outlay) for this project? (without excel)

b) What is the terminal cash flow associated with this project? (without excel)

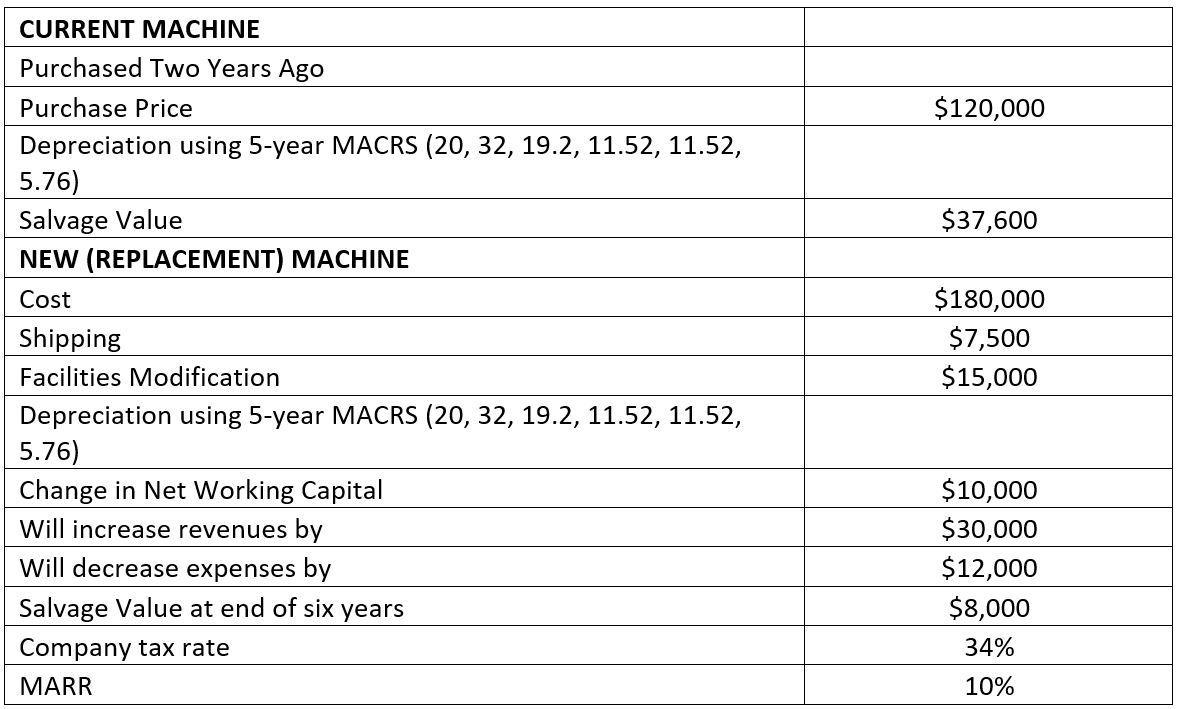

CURRENT MACHINE Purchased Two Years Ago Purchase Price $120,000 Depreciation using 5-year MACRS (20, 32, 19.2, 11.52, 11.52, 5.76) Salvage Value $37,600 NEW (REPLACEMENT) MACHINE $180,000 $7,500 $15,000 Cost Shipping Facilities Modification Depreciation using 5-year MACRS (20, 32, 19.2, 11.52, 11.52, 5.76) Change in Net Working Capital $10,000 $30,000 $12,000 $8,000 Will increase revenues by Will decrease expenses by Salvage Value at end of six years Company tax rate 34% MARR 10%

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

1 cost of new machine 180000 shipping cost 7500 facilities ... View full answer

Get step-by-step solutions from verified subject matter experts