Question: a) What is the difference between the fee structure of mutual funds and the fee structure of hedge funds? How does it impact their incentives

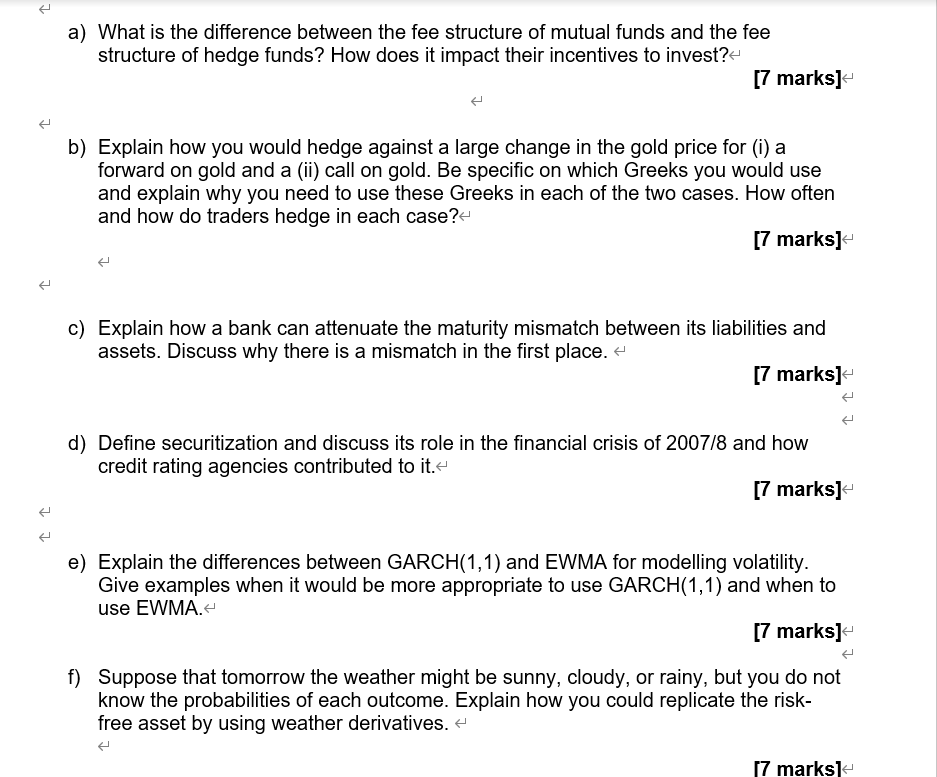

a) What is the difference between the fee structure of mutual funds and the fee structure of hedge funds? How does it impact their incentives to invest?- [7 marks] b) Explain how you would hedge against a large change in the gold price for (i) a forward on gold and a (ii) call on gold. Be specific on which Greeks you would use and explain why you need to use these Greeks in each of the two cases. How often and how do traders hedge in each case?- [7 marks] c) Explain how a bank can attenuate the maturity mismatch between its liabilities and assets. Discuss why there is a mismatch in the first place. [7 marks] d) Define securitization and discuss its role in the financial crisis of 2007/8 and how credit rating agencies contributed to it. [7 marks] L e) Explain the differences between GARCH(1,1) and EWMA for modelling volatility. Give examples when it would be more appropriate to use GARCH(1,1) and when to use EWMA.- (7 marks] f) Suppose that tomorrow the weather might be sunny, cloudy, or rainy, but you do not know the probabilities of each outcome. Explain how you could replicate the risk- free asset by using weather derivatives. 17 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts