Question: (a) What is the dividend received deduction? (This is a deduction. So write the number and the sign. For example, if the answer is -1000,

(a) What is the dividend received deduction? (This is a deduction. So write the number and the sign. For example, if the answer is -1000, write -1000 or -1,000)

(b) How much interest income does Brown need to include in its taxable income?

(c) How much net capital loss deduction can Brown take?

(d) How much charitable contribution deduction can Brown take? Hint: The charitable contribution deduction is limited to 10% of taxable income before the CCD, DRD, NOL and CL carryback, and the DPAD. Taxable income before the CCD and DRD (we have no NOL or CL carryback or DPAD in this problem) is $885,000.

(e) What is Brown's taxable income this year?

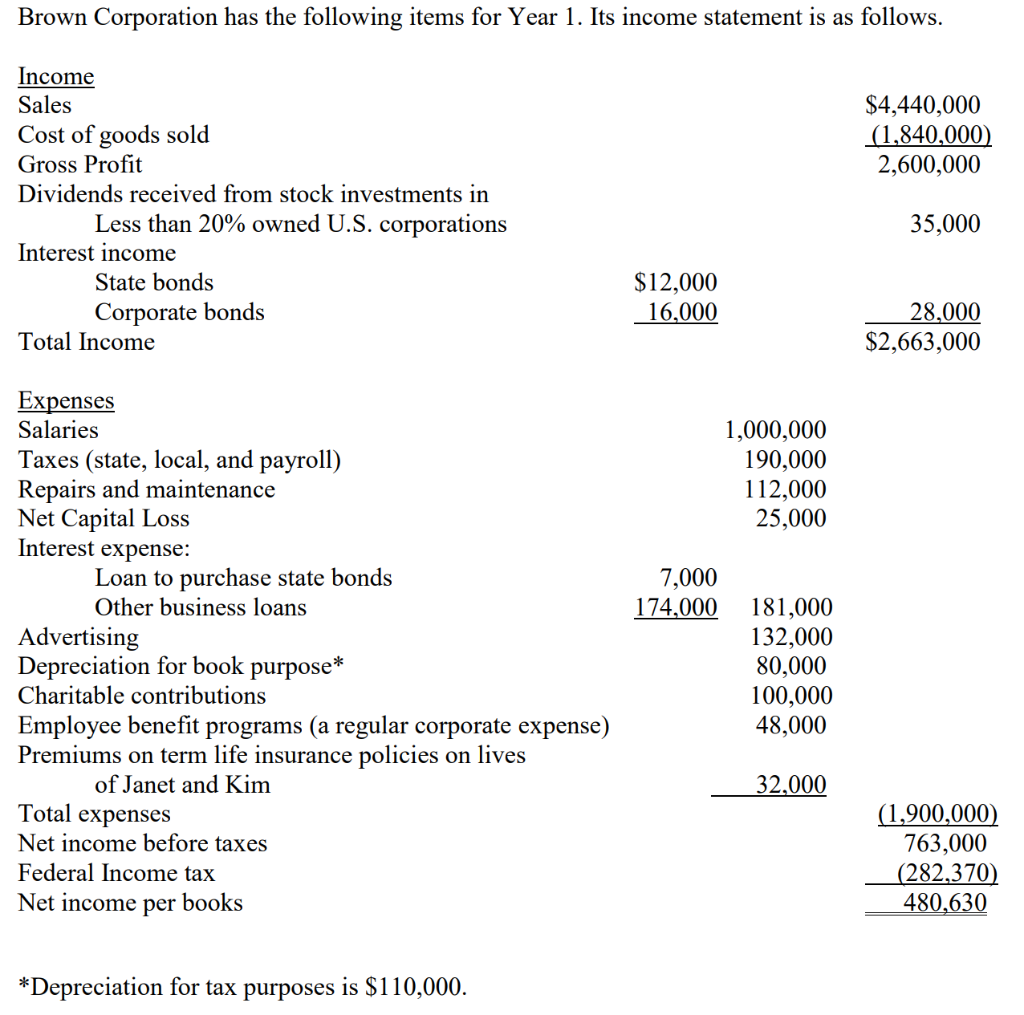

Brown Corporation has the following items for Year 1. Its income statement is as follows. $4,440,000 (1,840,000) 2,600,000 Income Sales Cost of goods sold Gross Profit Dividends received from stock investments in Less than 20% owned U.S. corporations Interest income State bonds Corporate bonds Total Income 35,000 $12,000 16,000 28,000 $2,663,000 1,000,000 190,000 112,000 25,000 7,000 174,000 Expenses Salaries Taxes (state, local, and payroll) Repairs and maintenance Net Capital Loss Interest expense: Loan to purchase state bonds Other business loans Advertising Depreciation for book purpose* Charitable contributions Employee benefit programs (a regular corporate expense) Premiums on term life insurance policies on lives of Janet and Kim Total expenses Net income before taxes Federal Income tax Net income per books 181,000 132,000 80,000 100,000 48,000 32,000 (1,900,000) 763,000 (282,370 480,630 *Depreciation for tax purposes is $110,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts