Question: A. what is the expected cash flow? Expected cash flow. ? B. what is the expected NPV? NPV ? C. Should Larry buy the new

A. what is the expected cash flow?

Expected cash flow. ?

B. what is the expected NPV?

NPV ?

C. Should Larry buy the new equipment?

Yes or No

I need step by step explanation plus answers.

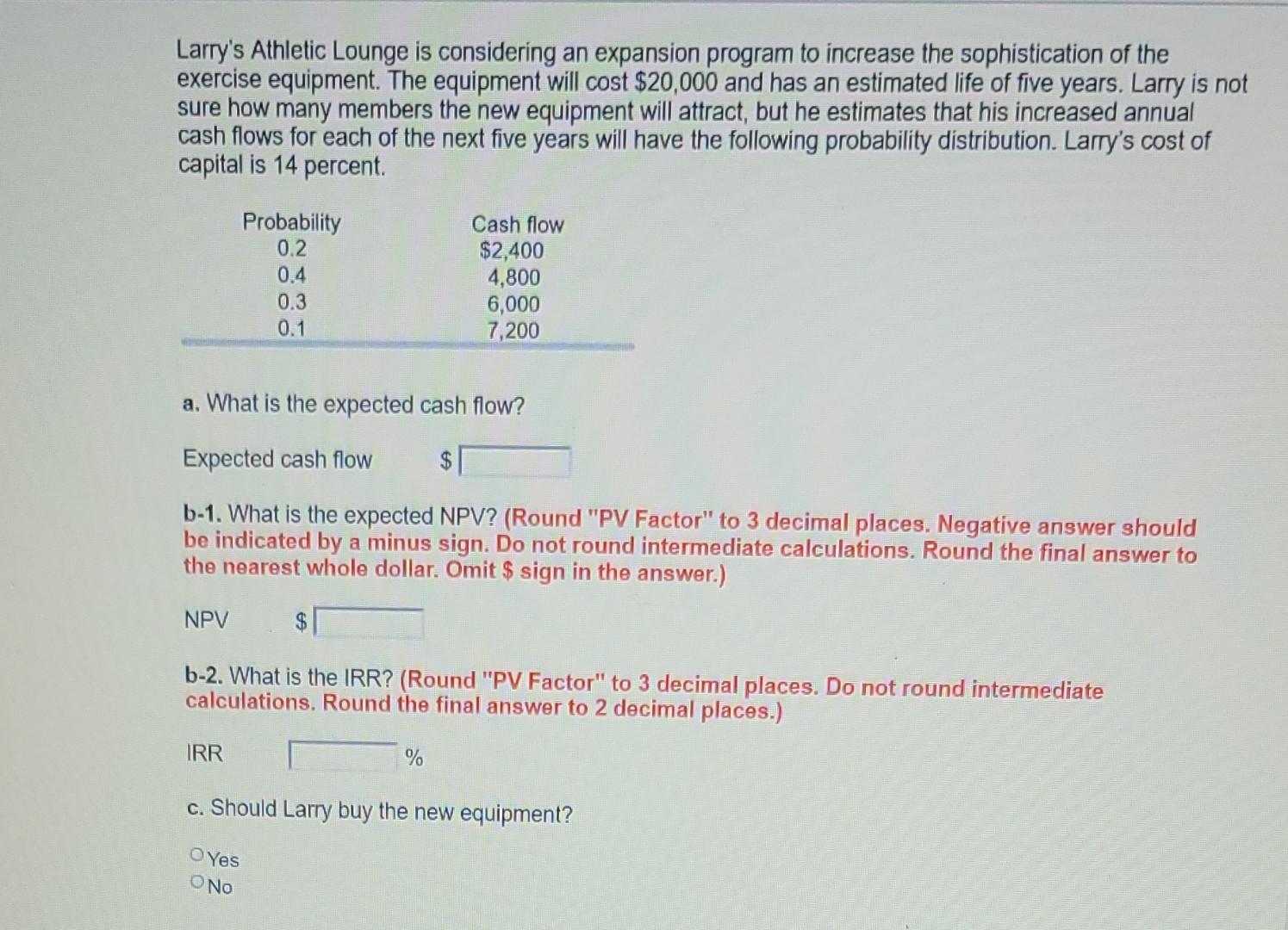

Larry's Athletic Lounge is considering an expansion program to increase the sophistication of the exercise equipment. The equipment will cost $20,000 and has an estimated life of five years. Larry is not sure how many members the new equipment will attract, but he estimates that his increased annual cash flows for each of the next five years will have the following probability distribution. Larry's cost of capital is 14 percent. a. What is the expected cash flow? Expected cash flow b-1. What is the expected NPV? (Round "PV Factor" to 3 decimal places. Negative answer should be indicated by a minus sign. Do not round intermediate calculations. Round the final answer to the nearest whole dollar. Omit \$ sign in the answer.) NPV $ b-2. What is the IRR? (Round "PV Factor" to 3 decimal places. Do not round intermediate calculations. Round the final answer to 2 decimal places.) IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts