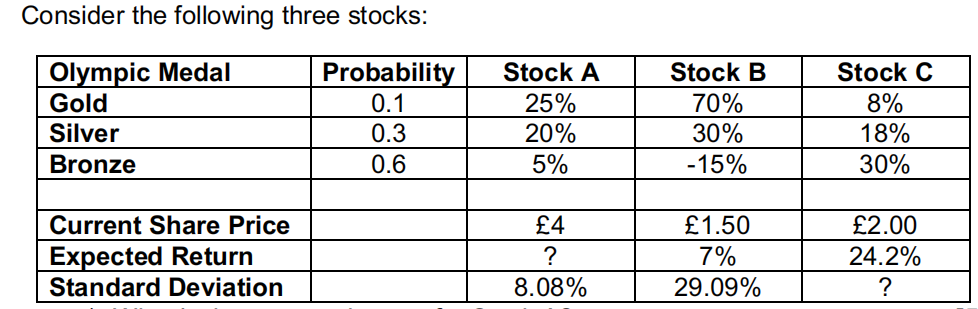

Question: a) What is the expected return for Stock A? b) What is the standard deviation for Stock C? c) Which of the three stocks is

a) What is the expected return for Stock A?

b) What is the standard deviation for Stock C?

c) Which of the three stocks is a rational investor most likely to purchase?

d) What is the expected return and standard deviation of a portfolio of 30 shares of Stock A, 30 shares of Stock B and 20 shares of Stock C?

e) Using graph explain Security Market Line (SML) and discuss that how based on SML investor can decide whether the certain stock is under-priced or overpriced.

Consider the following three stocks: Probability 0.1 0.3 0.6 Olympic Medal Gold Silver Bronze Current Share Price Expected Return Standard Deviation Stock A 25% 20% 5% 4 ? 8.08% Stock B 70% 30% -15% 1.50 7% 29.09% Stock C 8% 18% 30% 2.00 24.2% ?

Step by Step Solution

There are 3 Steps involved in it

a The expected return for Stock A is 25 b The standard deviation for Stock C is 30 c A rational investor would most likely purchase Stock C This is be... View full answer

Get step-by-step solutions from verified subject matter experts