Question: a. What is the expected return of the minimum variance portfolio? Express your answer in percentage terms rounded off to the nearest percent (e.g., if

a.

a.

What is the expected return of the minimum variance portfolio? Express your answer in percentage terms rounded off to the nearest percent (e.g., if your answer is 93.45%, write 93 in the answer box).

b.

What is the return volatility of the efficient portfolio whose expected return is 9%? Express your answer in percentage terms rounded off to the nearest percent (e.g., if your answer is 93.45%, write 93 in the answer box).

c.

Suppose further that the risk-free rate is 1%. What is the Sharpe Ratio of the tangent portfolio? Round your answer to two decimal places (e.g., if your answer is 0.3674, write 0.37 in the answer box).

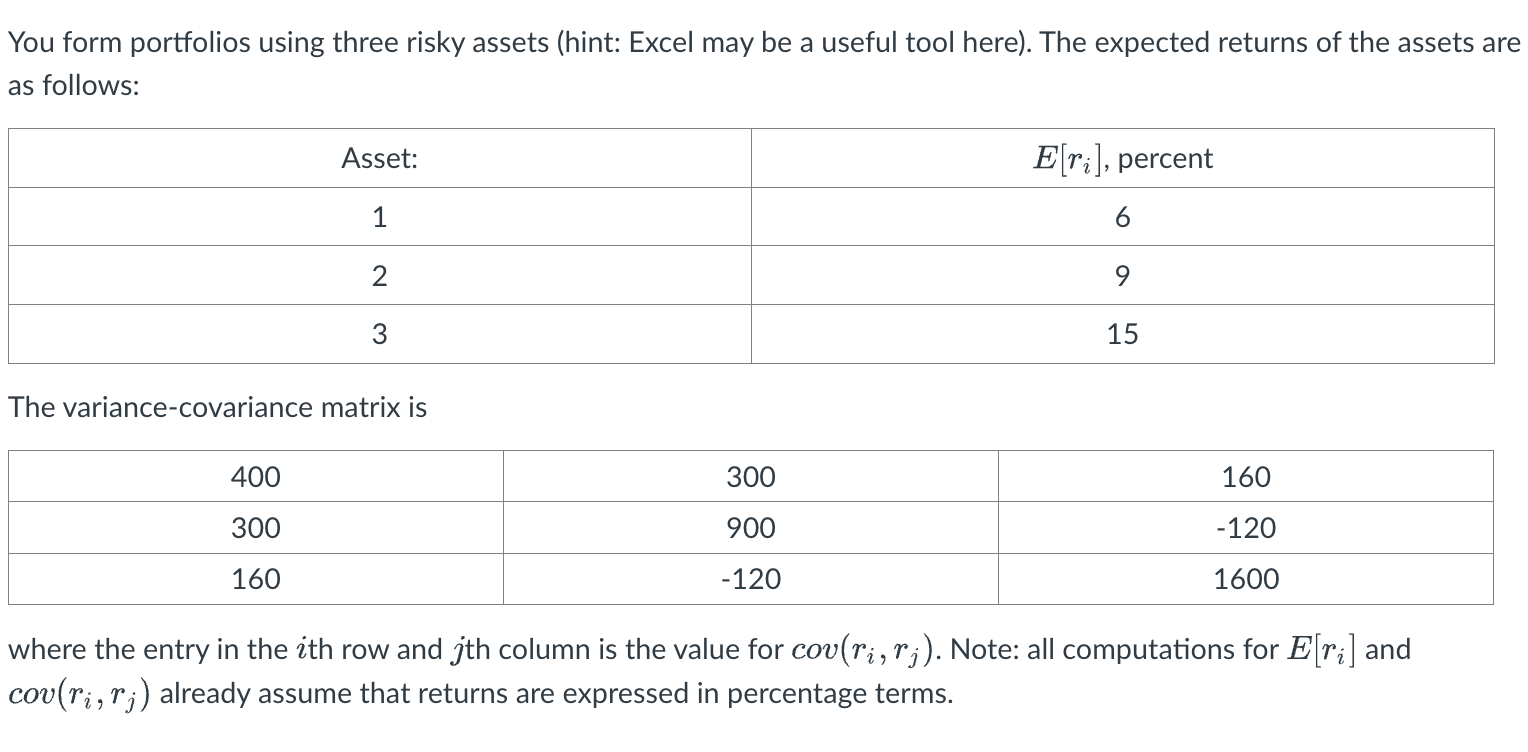

You form portfolios using three risky assets (hint: Excel may be a useful tool here). The expected returns of the assets are as follows: The variance-covariance matrix is where the entry in the i th row and j th column is the value for cov(ri,rj). Note: all computations for E[ri] and cov(ri,rj) already assume that returns are expressed in percentage terms

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts