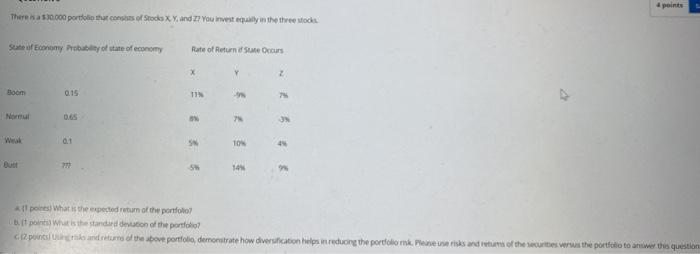

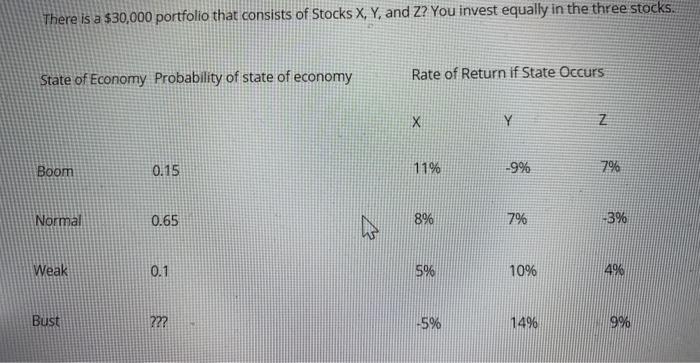

Question: a) what is the expected return pf the portfolio? b) what is the standard deviation of the portfolio? c) Using risks and returns of the

4 points There was 30.000 pertolo that of Stocks X Y and Z? You invest equity in the three stock Sure of Economy Probability of state of economy Rate of Return Secours X 2 Boom 0.15 11 7 Welk 5 10W 5 14% al poes What is the expected rutum of the portfolio buit points What is the standard destion of the portfolio 12 pensule ko and returns of the above portfolio, demonstrate how diversification helps in reduong the portfolio rink. Penee niks and return of the securities were the portfolio to answer this question There is a $30,000 portfolio that consists of Stocks X, Y, and Z? You invest equally in the three stocks. State of Economy Probability of state of economy Rate of Return if State Occurs X Z Boom 0.15 11% -9% 7% Normal 0.65 8% 7% -3% Weak 0.1 5% 10% 4% Bust 222 -5% 1496 9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts