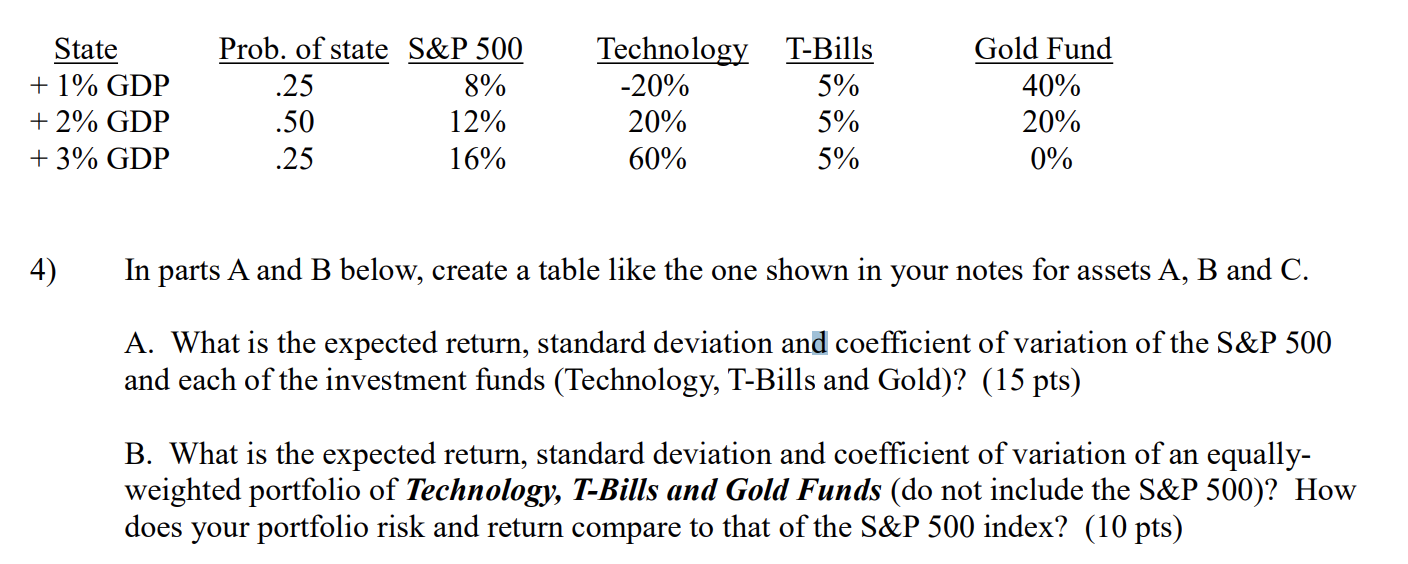

Question: A. What is the expected return, standard deviation and coefficient of variation of the S&P 500 and each of the investment funds (Technology, T-Bills and

A. What is the expected return, standard deviation and coefficient of variation of the S&P 500 and each of the investment funds (Technology, T-Bills and Gold)?

A. What is the expected return, standard deviation and coefficient of variation of the S&P 500 and each of the investment funds (Technology, T-Bills and Gold)?

B. What is the expected return, standard deviation and coefficient of variation of an equallyweighted portfolio of Technology, T-Bills and Gold Funds (do not include the S&P 500)? How does your portfolio risk and return compare to that of the S&P 500 index?

State + 1% GDP + 2% GDP + 3% GDP Prob. of state S&P 500 .25 8% .50 12% .25 16% Technology T-Bills -20% 5% 20% 60% 5% Gold Fund 40% 20% 0% 5% 4) In parts A and B below, create a table like the one shown in your notes for assets A, B and C. A. What is the expected return, standard deviation and coefficient of variation of the S&P 500 and each of the investment funds (Technology, T-Bills and Gold)? (15 pts) B. What is the expected return, standard deviation and coefficient of variation of an equally- weighted portfolio of Technology, T-Bills and Gold Funds (do not include the S&P 500)? How does your portfolio risk and return compare to that of the S&P 500 index? (10 pts) State + 1% GDP + 2% GDP + 3% GDP Prob. of state S&P 500 .25 8% .50 12% .25 16% Technology T-Bills -20% 5% 20% 60% 5% Gold Fund 40% 20% 0% 5% 4) In parts A and B below, create a table like the one shown in your notes for assets A, B and C. A. What is the expected return, standard deviation and coefficient of variation of the S&P 500 and each of the investment funds (Technology, T-Bills and Gold)? (15 pts) B. What is the expected return, standard deviation and coefficient of variation of an equally- weighted portfolio of Technology, T-Bills and Gold Funds (do not include the S&P 500)? How does your portfolio risk and return compare to that of the S&P 500 index? (10 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts