Question: a. What is the mid-rate for each maturity? b. What is the annual forward premium for all maturities? c. Which maturities have the smallest

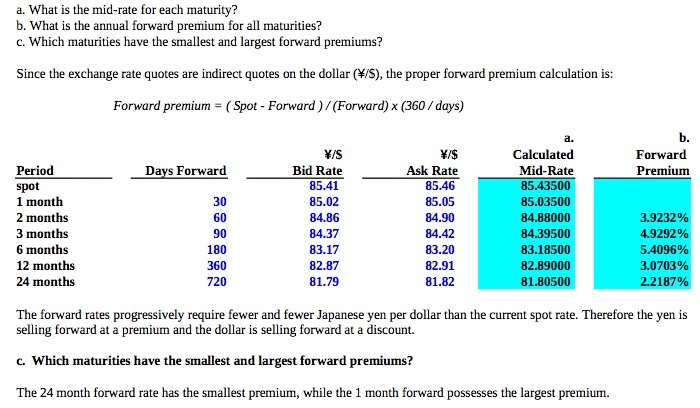

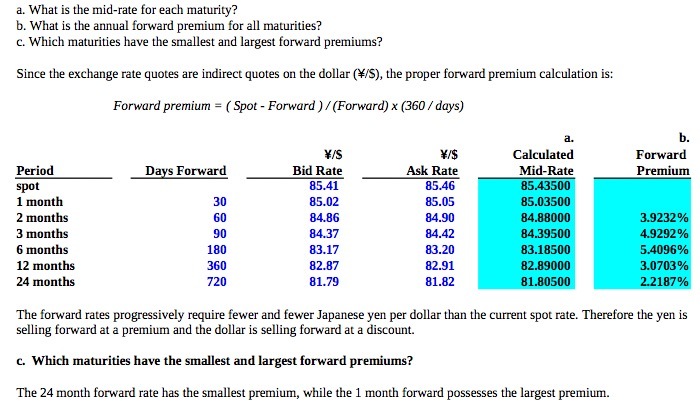

a. What is the mid-rate for each maturity? b. What is the annual forward premium for all maturities? c. Which maturities have the smallest and largest forward premiums? Since the exchange rate quotes are indirect quotes on the dollar (/S), the proper forward premium calculation is: Forward premium (Spot - Forward)/(Forward) x (360/days) a. b. \/S \/$ Calculated Bid Rate Ask Rate Mid-Rate Forward Premium 85.41 85.46 85.43500 30 85.02 85.05 85.03500 60 84.86 84.90 84.88000 3.9232% 90 84.37 84.42 84.39500 4.9292% 180 83.17 83.20 83.18500 5.4096% 360 82.87 82.91 82.89000 3.0703% 720 81.79 81.82 81.80500 2.2187% Period spot 1 month 2 months 3 months 6 months Days Forward 12 months 24 months The forward rates progressively require fewer and fewer Japanese yen per dollar than the current spot rate. Therefore the yen is selling forward at a premium and the dollar is selling forward at a discount. c. Which maturities have the smallest and largest forward premiums? The 24 month forward rate has the smallest premium, while the 1 month forward possesses the largest premium.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts