Question: a. What is the minimum amount per toy that Otter Land will be willing to accept for the one time only special order? 1. Will

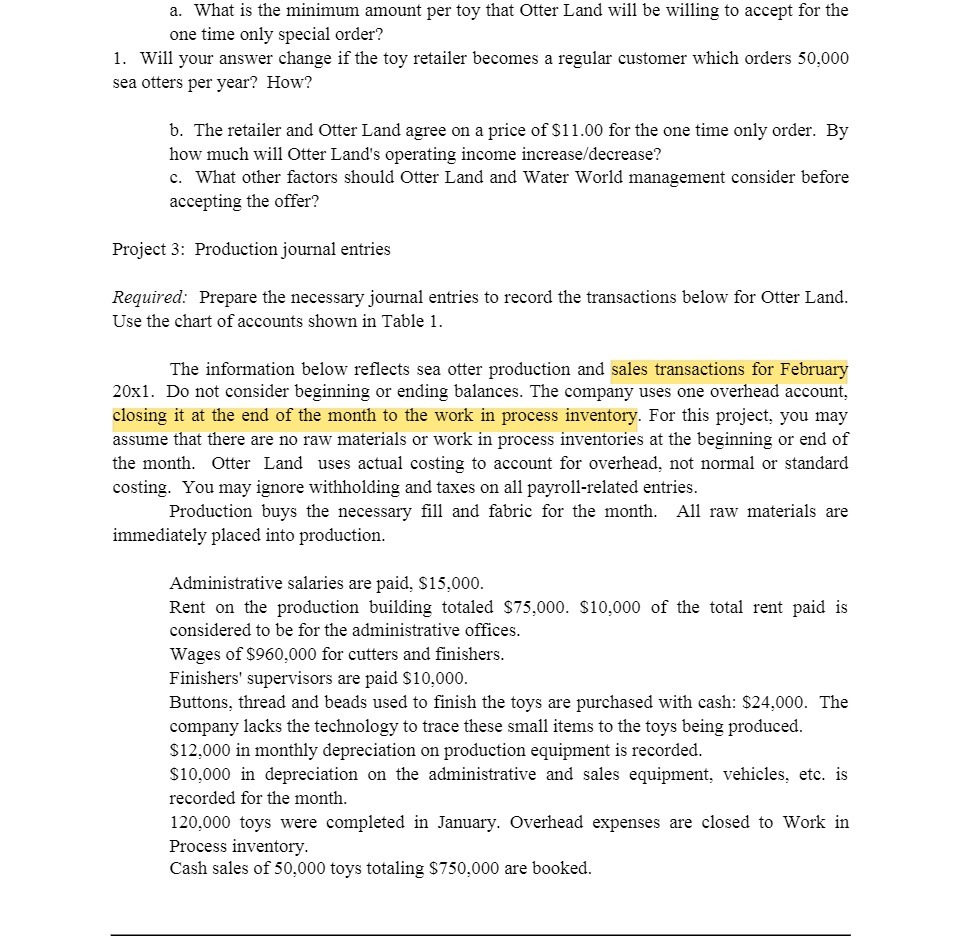

a. What is the minimum amount per toy that Otter Land will be willing to accept for the one time only special order? 1. Will your answer change if the toy retailer becomes a regular customer which orders 50,000 sea otters per year? How? b- The retailer and Otter Land agree on a price of $1 1.00 for the one time only order. By how much will Otter Land's operating income increasefdecrease? c. What other factors should Otter Land and Water World management consider before accepting the offer? Project 3: Production journal entries Required: Prepare the necessary journal entries to record the transactions below for Otter Land. Use the chart of accounts shown in Table 1. The information below reects sea otter production and sales transactions for February 20):]. Do not consider beginning or ending balances. The company uses one overhead account, closing it at the end of the month to the work in process inventory. For this project, you may assume that there are no raw materials or work in process inventories at the beginning or end of the month. Otter Land uses actual costing to account for overhead, not normal or standard costing. You may ignore withholding and taxes on all payroll-related entries. Production buys the necessary ll and fabric for the month. All raw materials are immediately placed into production. Administrative salaries are paid, $15,000. Rent on the production building totaled $75,000. $10,000 of the total rent paid is considered to be for the administrative oices. Wages of $960,000 for cutters and nishers. Finishers' supervisors are paid $10,000. Buttons, thread and beads used to nish the toys are purchased with cash: $24,000. The company lacks the technology to trace these small items to the toys being produced. 93 12,000 in monthly depreciation on production equipment is recorded. $10,000 in depreciation on the administrative and sales equipment, vehicles, etc. is recorded for the month. 120,000 toys were completed in January. Overhead expenses are closed to Work in Process inventory. Cash sales of 50,000 toys totaling $750,000 are booked

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts