Question: a.) what will their downpayment be? b.) what will the cost of their insurance be a month? c.) what will their taxes be a month?

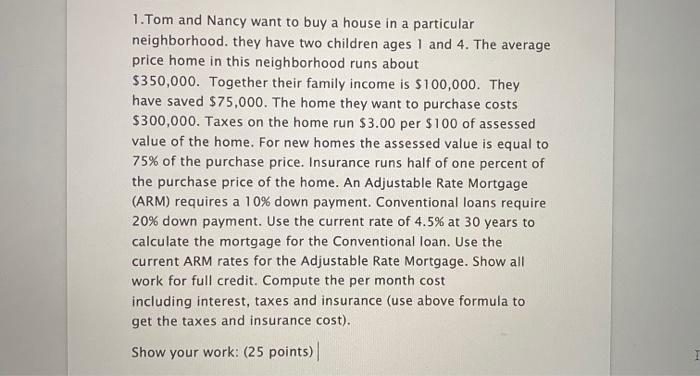

1. Tom and Nancy want to buy a house in a particular neighborhood, they have two children ages 1 and 4. The average price home in this neighborhood runs about $350,000. Together their family income is $100,000. They have saved $75,000. The home they want to purchase costs $300,000. Taxes on the home run 53.00 per $100 of assessed value of the home. For new homes the assessed value is equal to 75% of the purchase price. Insurance runs half of one percent of the purchase price of the home. An Adjustable Rate Mortgage (ARM) requires a 10% down payment. Conventional loans require 20% down payment. Use the current rate of 4.5% at 30 years to calculate the mortgage for the Conventional loan. Use the current ARM rates for the Adjustable Rate Mortgage. Show all work for full credit. Compute the per month cost including interest, taxes and insurance (use above formula to get the taxes and insurance cost), Show your work: (25 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts