Question: a . When are expenses deductible by a cash method taxpayer? A . A cash - method taxpayer deducts expenses when they are paid. A

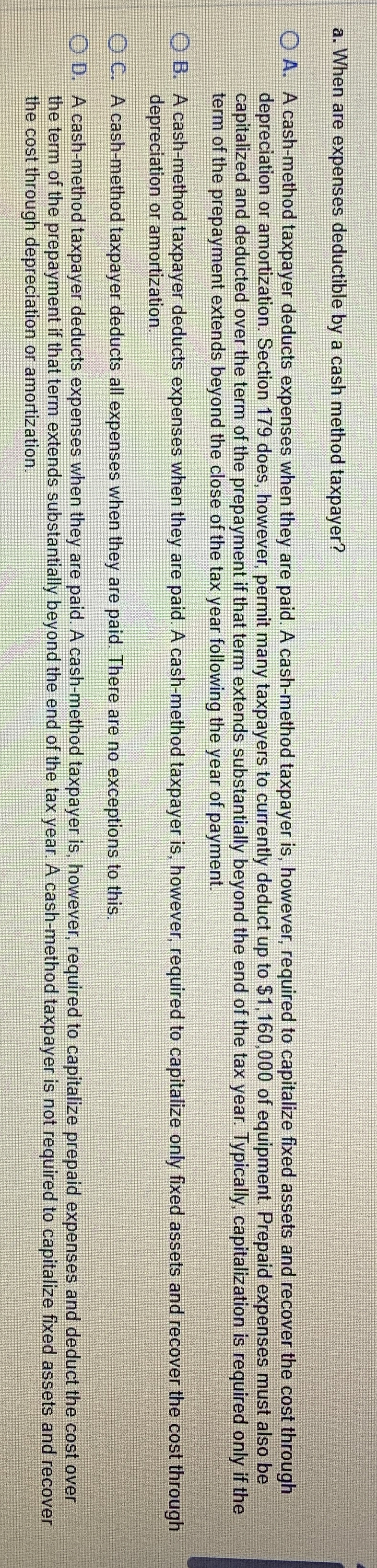

a When are expenses deductible by a cash method taxpayer?

A A cashmethod taxpayer deducts expenses when they are paid. A cashmethod taxpayer is however, required to capitalize fixed assets and recover the cost through depreciation or amortization. Section does, however, permit many taxpayers to currently deduct up to $ of equipment. Prepaid expenses must also be capitalized and deducted over the term of the prepayment if that term extends substantially beyond the end of the tax year. Typically, capitalization is required only if the term of the prepayment extends beyond the close of the tax year following the year of payment.

B A cashmethod taxpayer deducts expenses when they are paid. A cashmethod taxpayer is however, required to capitalize only fixed assets and recover the cost through depreciation or amortization.

C A cashmethod taxpayer deducts all expenses when they are paid. There are no exceptions to this.

D A cashmethod taxpayer deducts expenses when they are paid. A cashmethod taxpayer is however, required to capitalize prepaid expenses and deduct the cost over the term of the prepayment if that term extends substantially beyond the end of the tax year. A cashmethod taxpayer is not required to capitalize fixed assets and recover the cost through depreciation or amortization.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock