Question: (a), When caleulating cash flow from operations, one should: A. subtract depreciation since it represents the cost of replacing worn-out equipment. B. deduct the depreciation

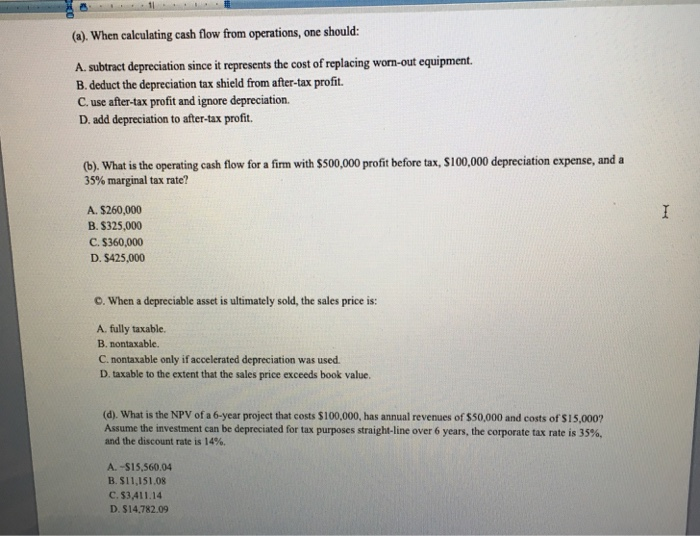

(a), When caleulating cash flow from operations, one should: A. subtract depreciation since it represents the cost of replacing worn-out equipment. B. deduct the depreciation tax shield from after-tax profit. C. use after-tax profit and ignore depreciation. D. add depreciation to after-tax profit. (b). What is the operating cash flow for a firm with $500,000 profit before tax, S100,000 depreciation expense, and a 35% marginal tax rate? A. $260,000 B. S325,000 C. $360,000 D. $425,000 C. When a depreciable asset is ultimately sold, the sales price is: A. fully taxable. B. nontaxable. C. nontaxable only if accelerated depreciation was used D taxable to the extent that the sales price exceeds book value. (d). What is the NPV of a 6-year project that costs $100,000, has annual revenues of $50,000 and costs of $15,000? Assume the investment can be depreciated for tax purposes straight-line over 6 years, the corporate tax rate is 35%, and the discount rate is 14%. A. $15,560.04 B. $11,151.08 C. $3,411.14 D. $14,782.09

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts