Question: a) Which portfolio is good to create? Provide a reason with reference b) Which Portfolio are overvalued and undervalued? Provide the reason why it is

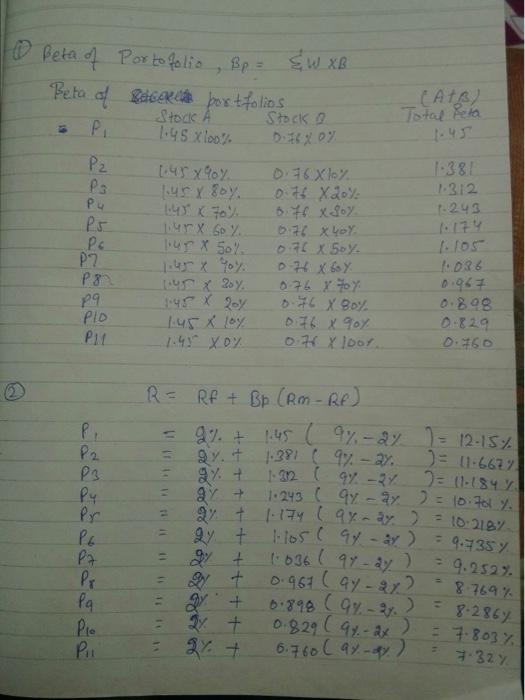

10 Beta of Portofolio Bp = {W XB Beta of Recerca portfolios Stock A Pi CA+B) Stock 1.45 8100% P2 Ps 1.45 890% Jury by 1:45. x. 70% 1.45X 60% 1.45 X 50% 1:38 1-312 1.243 Pu 1.105 Pr Pc P2 P8 29 Plo Pit 0.76 xley 0.76 X.20% BH X Soy 0.76 x 40 0.76 x 50% 0 4 X 66% 0.76 x toy 07 Y 80% 0.76 X 90% OH x Dot 1.4 x 2 0.067 0.8.98 0-829 0.760 1.48 XO% = 11-667% 2= 11:184 Y P P2 P3 Py Pr PG Pz Pr Pg Pie Put R = Rf + Bp (Rm - Re) 2% + 1.45 ( 9%-24 = 12-15% gy. + 1.381 ( 9%-27. 1. 32 ( 94.-24. ay + 1.243 ( 9%-ay. = 10.70 % ay + 1-174 9xmay. 2 10:2182 gy+ 1.los ( 94 - 21 ) gyt 1.036 ( 97-2y) + 0.961 ( ay - 2x2 -+ 0.898 94.-27. 0.82994.- 2x 6.760 ( ay-ay) 7.327 1111111 9.35% 9.252%. 8 769% 8.2867 7.8.03% ( 10 Beta of Portofolio Bp = {W XB Beta of Recerca portfolios Stock A Pi CA+B) Stock 1.45 8100% P2 Ps 1.45 890% Jury by 1:45. x. 70% 1.45X 60% 1.45 X 50% 1:38 1-312 1.243 Pu 1.105 Pr Pc P2 P8 29 Plo Pit 0.76 xley 0.76 X.20% BH X Soy 0.76 x 40 0.76 x 50% 0 4 X 66% 0.76 x toy 07 Y 80% 0.76 X 90% OH x Dot 1.4 x 2 0.067 0.8.98 0-829 0.760 1.48 XO% = 11-667% 2= 11:184 Y P P2 P3 Py Pr PG Pz Pr Pg Pie Put R = Rf + Bp (Rm - Re) 2% + 1.45 ( 9%-24 = 12-15% gy. + 1.381 ( 9%-27. 1. 32 ( 94.-24. ay + 1.243 ( 9%-ay. = 10.70 % ay + 1-174 9xmay. 2 10:2182 gy+ 1.los ( 94 - 21 ) gyt 1.036 ( 97-2y) + 0.961 ( ay - 2x2 -+ 0.898 94.-27. 0.82994.- 2x 6.760 ( ay-ay) 7.327 1111111 9.35% 9.252%. 8 769% 8.2867 7.8.03% (

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts