Question: ( a ) Why do bond prices go down when market interest rates go up ? Why don't bondholders like to receive high market interest

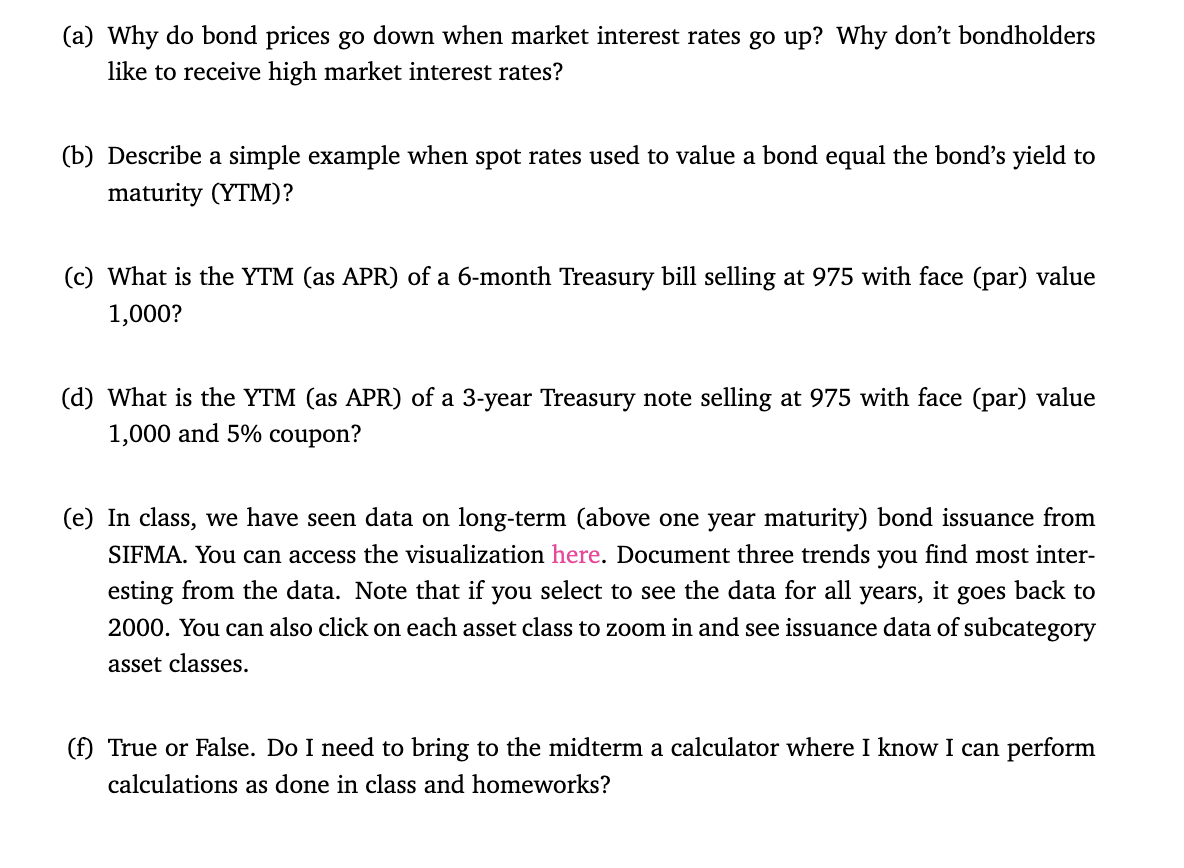

a Why do bond prices go down when market interest rates go up Why don't bondholders like to receive high market interest rates? b Describe a simple example when spot rates used to value a bond equal the bond's yield to maturity YTMc What is the YTM as APR of a month Treasury bill selling at with face par value d What is the YTM as APR of a year Treasury note selling at with face par value and coupon? e In class, we have seen data on longterm above one year maturity bond issuance from SIFMA. You can access the visualization here. Document three trends you find most interesting from the data. Note that if you select to see the data for all years, it goes back to You can also click on each asset class to zoom in and see issuance data of subcategory asset classes. f True or False. Do I need to bring to the midterm a calculator where I know I can perform calculations as done in class and homeworks?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock