Question: a . Why is this the case? A . Most estates are not subject to the federal estate tax because the unified tax credit and

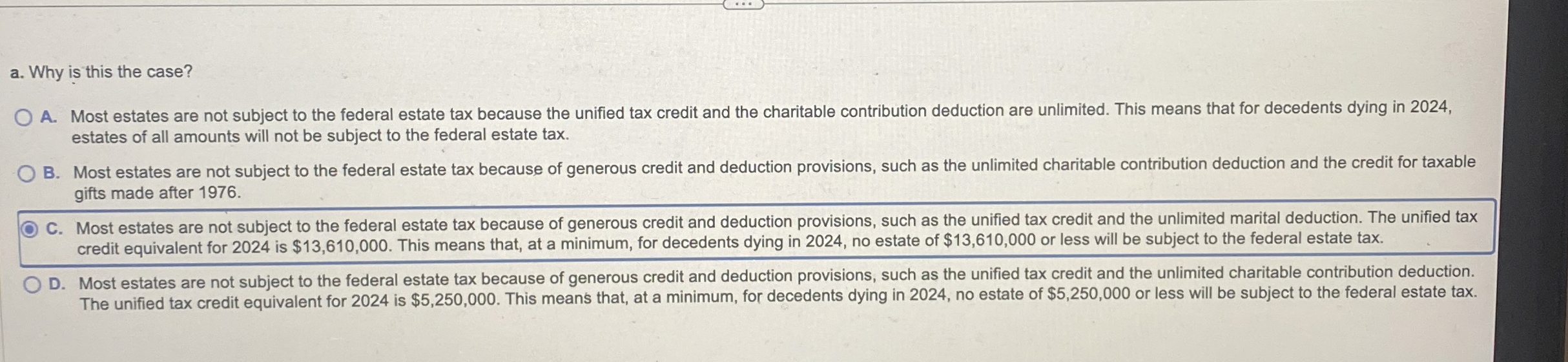

a Why is this the case?

A Most estates are not subject to the federal estate tax because the unified tax credit and the charitable contribution deduction are unlimited. This means that for decedents dying in estates of all amounts will not be subject to the federal estate tax.

B Most estates are not subject to the federal estate tax because of generous credit and deduction provisions, such as the unlimited charitable contribution deduction and the credit for taxable gifts made after

C Most estates are not subject to the federal estate tax because of generous credit and deduction provisions, such as the unified tax credit and the unlimited marital deduction. The unified tax credit equivalent for is $ This means that, at a minimum, for decedents dying in no estate of $ or less will be subject to the federal estate tax.

D Most estates are not subject to the federal estate tax because of generous credit and deduction provisions, such as the unified tax credit and the unlimited charitable contribution deduction. The unified tax credit equivalent for is $ This means that, at a minimum, for decedents dying in no estate of $ or less will be subject to the federal estate tax.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock