Question: A. With reference to the recent quantitative easing exercises of larger developed countries, explain the difference between sterilized and non-sterilized government intervention, and state

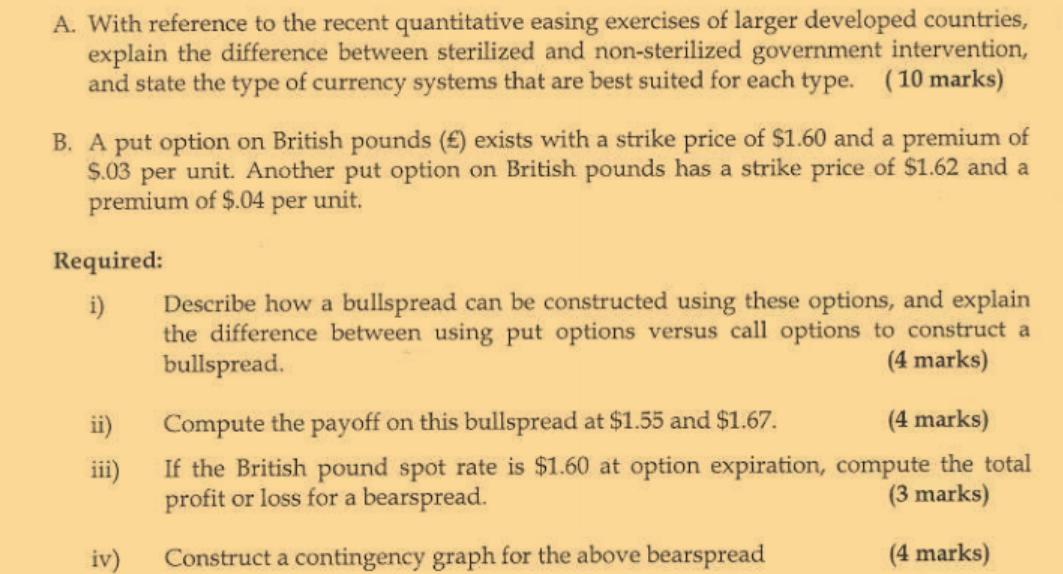

A. With reference to the recent quantitative easing exercises of larger developed countries, explain the difference between sterilized and non-sterilized government intervention, and state the type of currency systems that are best suited for each type. (10 marks) B. A put option on British pounds () exists with a strike price of $1.60 and a premium of $.03 per unit. Another put option on British pounds has a strike price of $1.62 and a premium of $.04 per unit. Required: i) Describe how a bullspread can be constructed using these options, and explain the difference between using put options versus call options to construct a bullspread. (4 marks) ii) Compute the payoff on this bullspread at $1.55 and $1.67. (4 marks) iii) If the British pound spot rate is $1.60 at option expiration, compute the total profit or loss for a bearspread. (3 marks) iv) Construct a contingency graph for the above bearspread (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Answer A Sterilized vs NonSterilized Government Intervention 10 marks Sterilized Intervention Central bank buyssells foreign currency while offsetting the impact on domestic money supply Techniques Op... View full answer

Get step-by-step solutions from verified subject matter experts