Question: A wood processing company purchases a new machine for its factory at a significant cost. This equipment has an expected useful life of 10 years

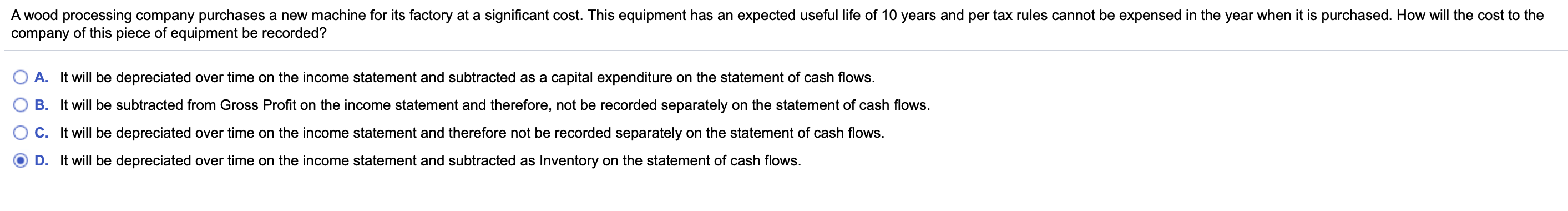

A wood processing company purchases a new machine for its factory at a significant cost. This equipment has an expected useful life of 10 years and per tax rules cannot be expensed in the year when it is purchased. How will the cost to the company of this piece of equipment be recorded? O A. It will be depreciated over time on the income statement and subtracted as a capital expenditure on the statement of cash flows. B. It will be subtracted from Gross Profit on the income statement and therefore, not be recorded separately on the statement of cash flows. C. It will be depreciated over time on the income statement and therefore not be recorded separately on the statement of cash flows. D. It will be depreciated over time on the income statement and subtracted as Inventory on the statement of cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts