Question: (a) Write a short essay in which you compare the relative advantages and shortcomings of Discounted Cashflow (DCF) and REAL options analysis. Does the

![Pricing formula as: Value of Call option = [N(d1 )xP] - [N(d2](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2021/07/60dd7e7ac8873_1625128569387.jpg)

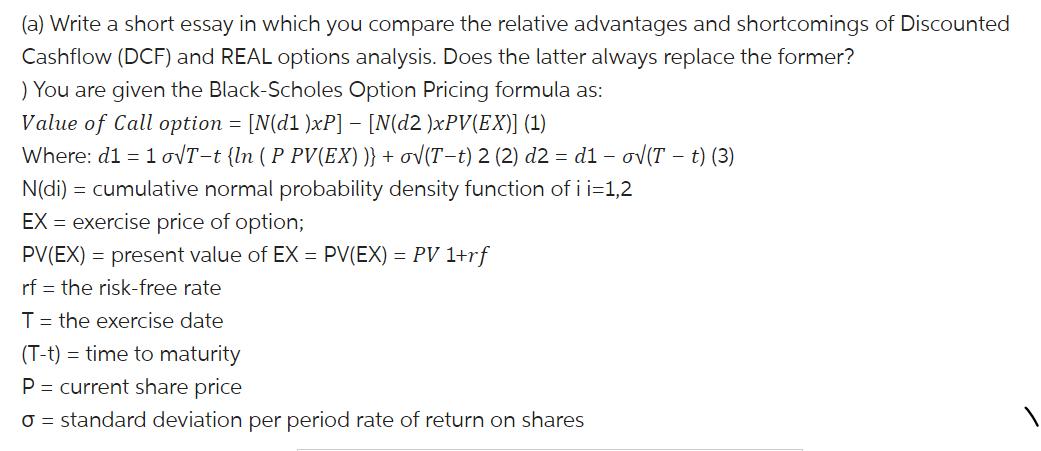

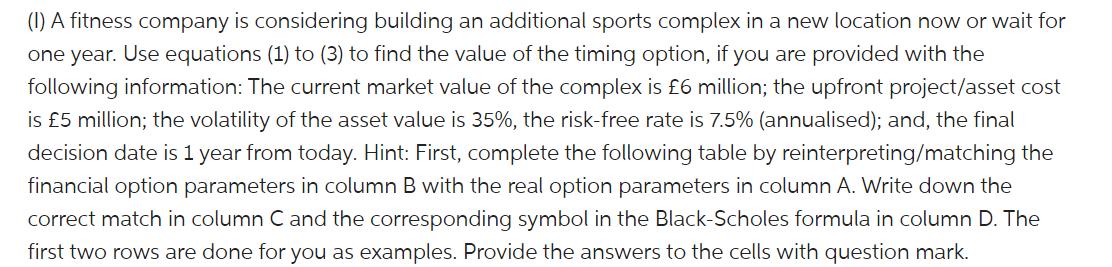

(a) Write a short essay in which you compare the relative advantages and shortcomings of Discounted Cashflow (DCF) and REAL options analysis. Does the latter always replace the former? ) You are given the Black-Scholes Option Pricing formula as: Value of Call option = [N(d1 )xP] - [N(d2 )xPV(EX)] (1) Where: d1 = 1 oT-t {ln ( P PV(EX))} + o(T-t) 2 (2) d2 = d1 - o(T - t) (3) N(di) = cumulative normal probability density function of i i=1,2 EX = exercise price of option; PV(EX) = present value of EX = PV(EX) = PV 1+rf rf the risk-free rate T = the exercise date (T-t) = time to maturity P = current share price = standard deviation per period rate of return on shares (1) A fitness company is considering building an additional sports complex in a new location now or wait for one year. Use equations (1) to (3) to find the value of the timing option, if you are provided with the following information: The current market value of the complex is 6 million; the upfront project/asset cost is 5 million; the volatility of the asset value is 35%, the risk-free rate is 7.5% (annualised); and, the final decision date is 1 year from today. Hint: First, complete the following table by reinterpreting/matching the financial option parameters in column B with the real option parameters in column A. Write down the correct match in column C and the corresponding symbol in the Black-Scholes formula in column D. The first two rows are done for you as examples. Provide the answers to the cells with question mark. Financial option Real option (column A) (unmatched) Financial option (matched) (column B) (column C) Volatility of Volatility of Expiration date asset value stock Final decision Risk-free rate Expiration date date Risk-free rate Stock price ? Current market Exercise price ? value of the asset/sports complex Upfront project Volatility of ? stock cost Symbol in the Value Black-Scholes model above (column D) 0 T ? ? ? (column E) 35% 1 year 7.5% 6 million 5 million (ii) Is it optimal to wait if the NPV of investing immediately is 2.75 million? (iii) Calculate the value of the PUT option using the PUT-CALL parity.

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Cash Flow Statement helps the management to ascertain the liquidity and profitability position of a ... View full answer

Get step-by-step solutions from verified subject matter experts