Question: (a) X Ltd. issues 1.5 crore convertible bonds on 1st April, 2018. The bonds have a life of 8 years and a face value

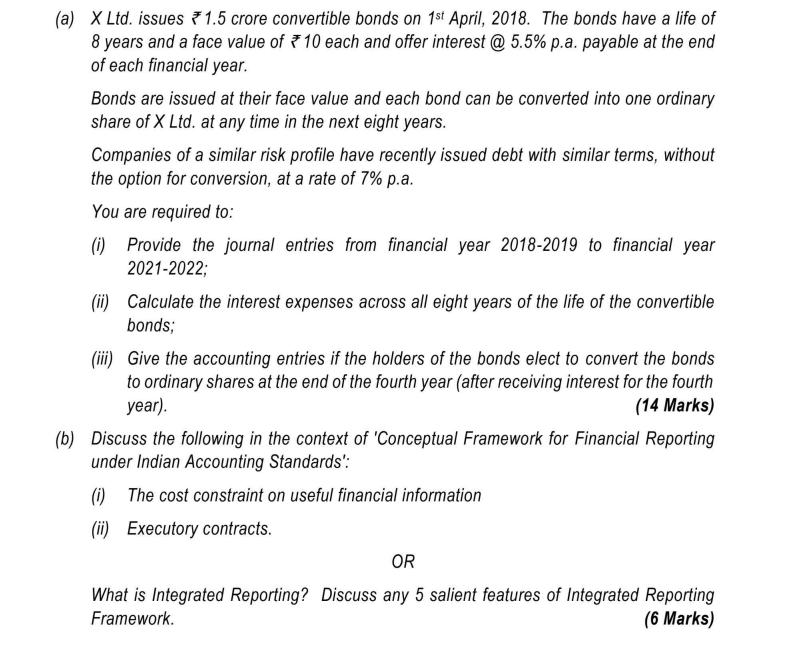

(a) X Ltd. issues 1.5 crore convertible bonds on 1st April, 2018. The bonds have a life of 8 years and a face value of 10 each and offer interest @ 5.5% p.a. payable at the end of each financial year. Bonds are issued at their face value and each bond can be converted into one ordinary share of X Ltd. at any time in the next eight years. Companies of a similar risk profile have recently issued debt with similar terms, without the option for conversion, at a rate of 7% p.a. You are required to: (i) Provide the journal entries from financial year 2018-2019 to financial year 2021-2022; (ii) Calculate the interest expenses across all eight years of the life of the convertible bonds; (iii) Give the accounting entries if the holders of the bonds elect to convert the bonds to ordinary shares at the end of the fourth year (after receiving interest for the fourth year). (14 Marks) (b) Discuss the following in the context of 'Conceptual Framework for Financial Reporting under Indian Accounting Standards': (i) The cost constraint on useful financial information (ii) Executory contracts. OR What is Integrated Reporting? Discuss any 5 salient features of Integrated Reporting Framework. (6 Marks)

Step by Step Solution

There are 3 Steps involved in it

The detailed ... View full answer

Get step-by-step solutions from verified subject matter experts