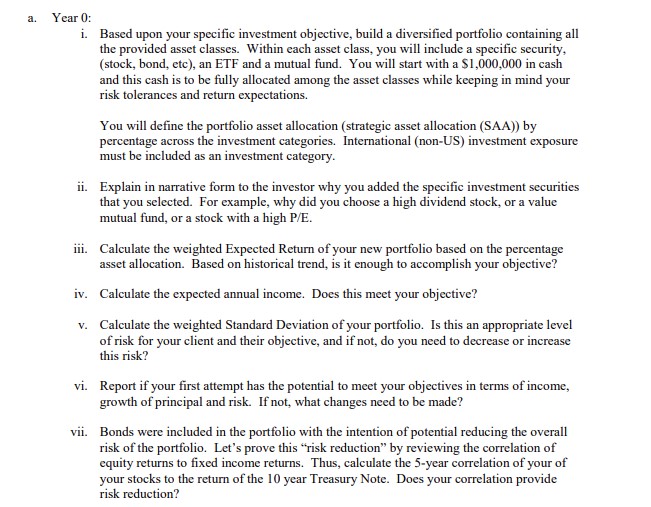

Question: a . Year 0 : i . Based upon your specific investment objective, build a diversified portfolio containing all the provided asset classes. Within each

a Year :

i Based upon your specific investment objective, build a diversified portfolio containing all

the provided asset classes. Within each asset class, you will include a specific security,

stock bond, etc an ETF and a mutual fund. You will start with a $ in cash

and this cash is to be fully allocated among the asset classes while keeping in mind your

risk tolerances and return expectations.

You will define the portfolio asset allocation strategic asset allocation SAA by

percentage across the investment categories. International nonUS investment exposure

must be included as an investment category.

ii Explain in narrative form to the investor why you added the specific investment securities

that you selected. For example, why did you choose a high dividend stock, or a value

mutual fund, or a stock with a high

iii. Calculate the weighted Expected Return of your new portfolio based on the percentage

asset allocation. Based on historical trend, is it enough to accomplish your objective?

iv Calculate the expected annual income. Does this meet your objective?

v Calculate the weighted Standard Deviation of your portfolio. Is this an appropriate level

of risk for your client and their objective, and if not, do you need to decrease or increase

this risk?

vi Report if your first attempt has the potential to meet your objectives in terms of income,

growth of principal and risk. If not, what changes need to be made?

vii. Bonds were included in the portfolio with the intention of potential reducing the overall

risk of the portfolio. Let's prove this "risk reduction" by reviewing the correlation of

equity returns to fixed income returns. Thus, calculate the year correlation of your of

your stocks to the return of the year Treasury Note. Does your correlation provide

risk reduction?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock