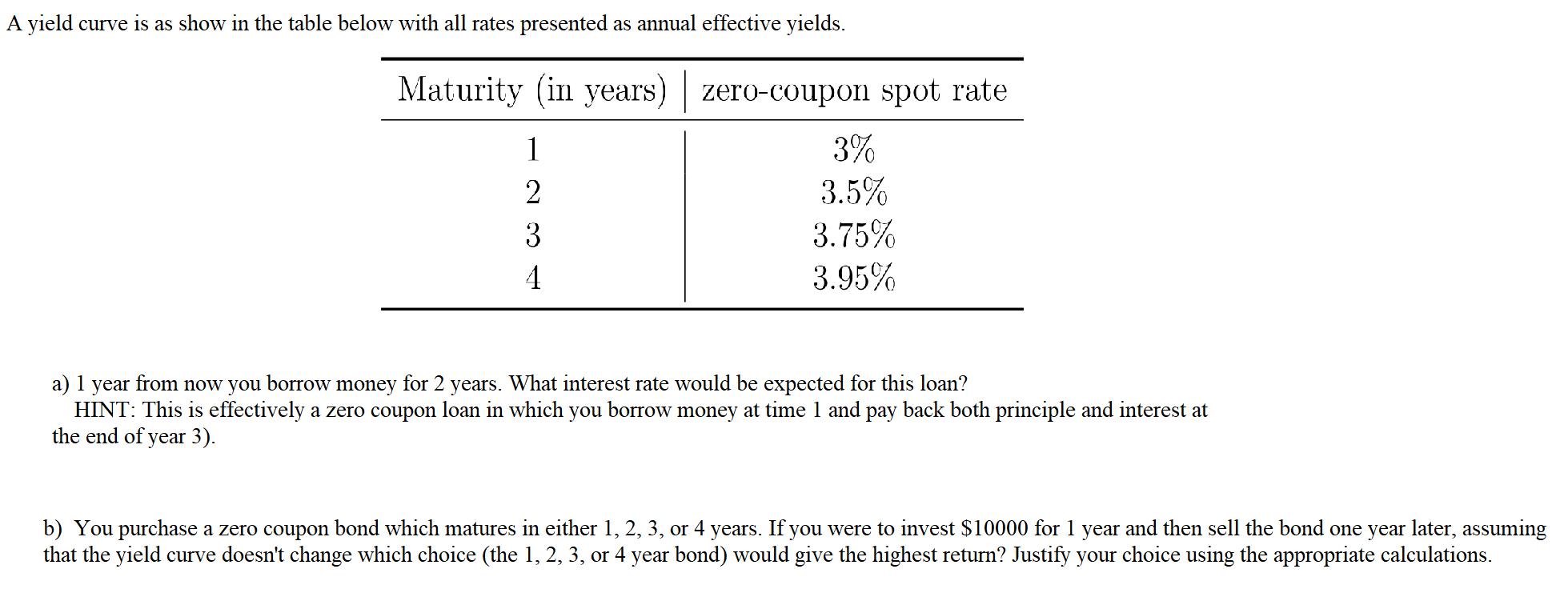

Question: A yield curve is as show in the table below with all rates presented as annual effective yields. Maturity (in years) zero-coupon spot rate

A yield curve is as show in the table below with all rates presented as annual effective yields. Maturity (in years) zero-coupon spot rate 1 2 3 3% 3.5% 3.75% 3.95% a) 1 year from now you borrow money for 2 years. What interest rate would be expected for this loan? HINT: This is effectively a zero coupon loan in which you borrow money at time 1 and pay back both principle and interest at the end of year 3). b) You purchase a zero coupon bond which matures in either 1, 2, 3, or 4 years. If you were to invest $10000 for 1 year and then sell the bond one year later, assuming that the yield curve doesn't change which choice (the 1, 2, 3, or 4 year bond) would give the highest return? Justify your choice using the appropriate calculations.

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

a To determine the expected interest rate for the loan we need to calculate the implied forward rate ... View full answer

Get step-by-step solutions from verified subject matter experts