Question: a You are a portfolio manager dealing with a difficult client who has you are an unusually low risk aversion (A = 5). You consider

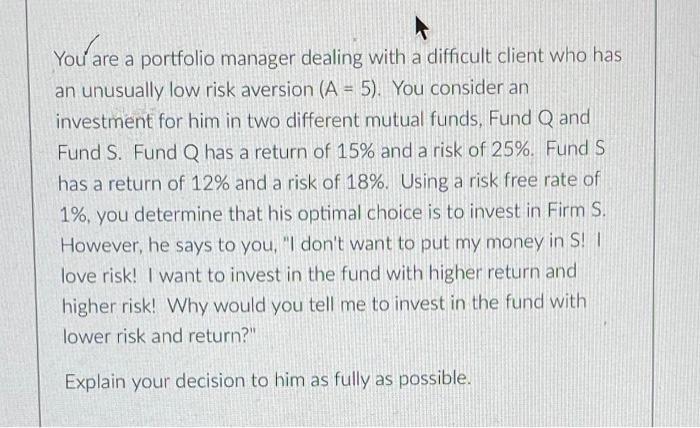

a You are a portfolio manager dealing with a difficult client who has you are an unusually low risk aversion (A = 5). You consider an investment for him in two different mutual funds, Fund Q and Fund S. Fund Q has a return of 15% and a risk of 25%. Fund S has a return of 12% and a risk of 18%. Using a risk free rate of a 1%, you determine that his optimal choice is to invest in Firm S. However, he says to you, "I don't want to put my money in S! | love risk! I want to invest in the fund with higher return and higher risk! Why would you tell me to invest in the fund with lower risk and return?" Explain your decision to him as fully as possible. a You are a portfolio manager dealing with a difficult client who has you are an unusually low risk aversion (A = 5). You consider an investment for him in two different mutual funds, Fund Q and Fund S. Fund Q has a return of 15% and a risk of 25%. Fund S has a return of 12% and a risk of 18%. Using a risk free rate of a 1%, you determine that his optimal choice is to invest in Firm S. However, he says to you, "I don't want to put my money in S! | love risk! I want to invest in the fund with higher return and higher risk! Why would you tell me to invest in the fund with lower risk and return?" Explain your decision to him as fully as possible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts