Question: a. = You are considering constructing a portfolio that consists of one risky (asset A) and one riskless asset. From the historical data you know

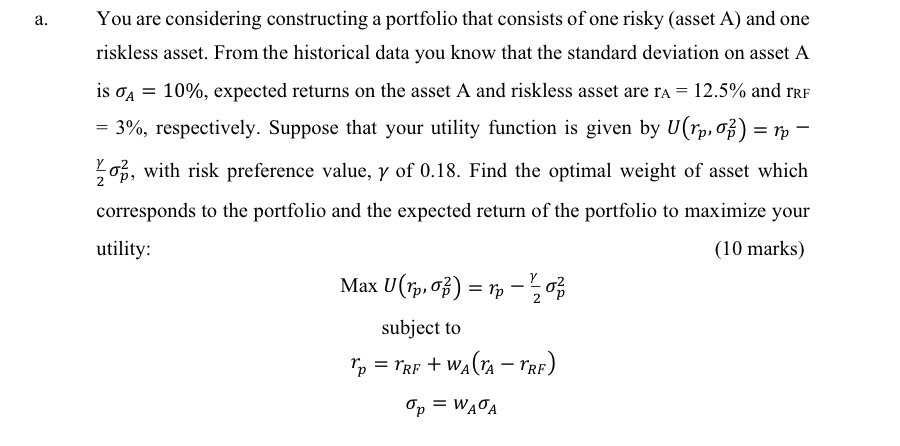

a. = You are considering constructing a portfolio that consists of one risky (asset A) and one riskless asset. From the historical data you know that the standard deviation on asset A is oa = 10%, expected returns on the asset A and riskless asset are ra = 12.5% and rrf = 3%, respectively. Suppose that your utility function is given by U(Tp, o%) = op, with risk preference value, y of 0.18. Find the optimal weight of asset which corresponds to the portfolio and the expected return of the portfolio to maximize your utility: (10 marks) Max U(lip, o) = rp - subject to Po = rrf + wA(TA - PRF) Op = WAA a. = You are considering constructing a portfolio that consists of one risky (asset A) and one riskless asset. From the historical data you know that the standard deviation on asset A is oa = 10%, expected returns on the asset A and riskless asset are ra = 12.5% and rrf = 3%, respectively. Suppose that your utility function is given by U(Tp, o%) = op, with risk preference value, y of 0.18. Find the optimal weight of asset which corresponds to the portfolio and the expected return of the portfolio to maximize your utility: (10 marks) Max U(lip, o) = rp - subject to Po = rrf + wA(TA - PRF) Op = WAA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts