Question: a. You are contemplating purchasing a $100,000 bond which has a 3.5% coupon. The bond pays coupon quarterly. Rates have risen due to inflation

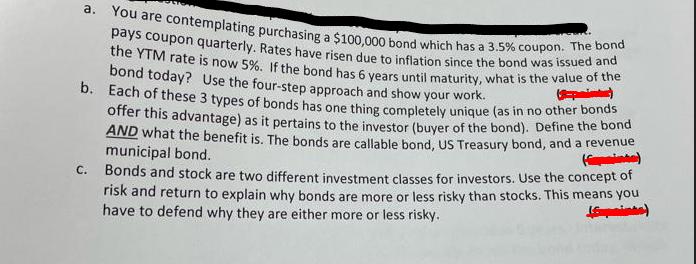

a. You are contemplating purchasing a $100,000 bond which has a 3.5% coupon. The bond pays coupon quarterly. Rates have risen due to inflation since the bond was issued and the YTM rate is now 5%. If the bond has 6 years until maturity, what is the value of the bond today? Use the four-step approach and show your work. b. Each of these 3 types of bonds has one thing completely unique (as in no other bonds offer this advantage) as it pertains to the investor (buyer of the bond). Define the bond AND what the benefit is. The bonds are callable bond, US Treasury bond, and a revenue municipal bond. (finte) (painted) Bonds and stock are two different investment classes for investors. Use the concept of risk and return to explain why bonds are more or less risky than stocks. This means you have to defend why they are either more or less risky. (Expainte) C.

Step by Step Solution

3.36 Rating (162 Votes )

There are 3 Steps involved in it

a To calculate the value of the bond today we can use the fourstep approach as follows Step 1 Calculate the coupon payment per period Coupon payment per period Coupon rate x Face value Number of coupo... View full answer

Get step-by-step solutions from verified subject matter experts