Question: a You are evaluating two different machines. The Defcon I costs $450,000, has a five- year life that will be depreciated down to zero using

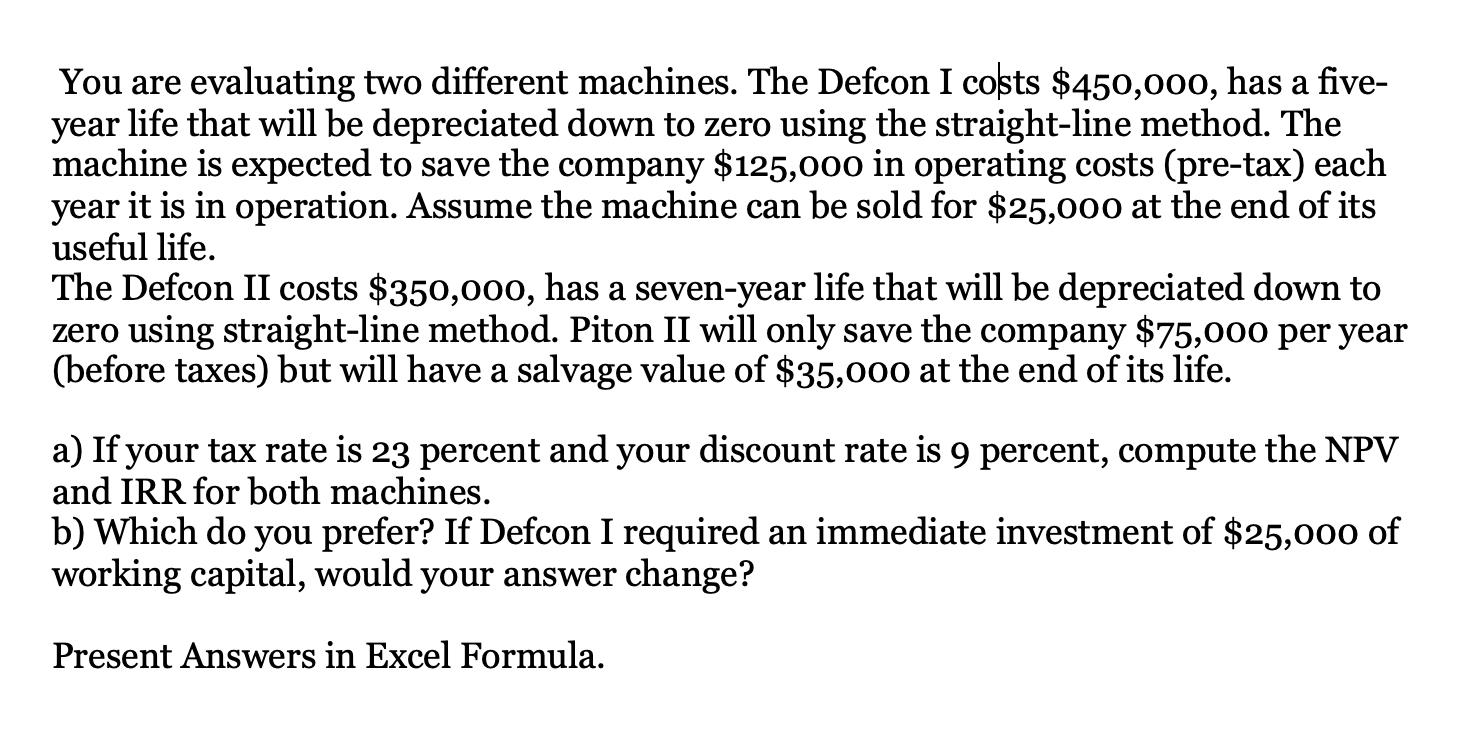

a You are evaluating two different machines. The Defcon I costs $450,000, has a five- year life that will be depreciated down to zero using the straight-line method. The machine is expected to save the company $125,000 in operating costs (pre-tax) each year it is in operation. Assume the machine can be sold for $25,000 at the end of its useful life. The Defcon II costs $350,000, has a seven-year life that will be depreciated down to zero using straight-line method. Piton II will only save the company $75,000 per year (before taxes) but will have a salvage value of $35,000 at the end of its life. a) If your tax rate is 23 percent and your discount rate is 9 percent, compute the NPV and IRR for both machines. b) Which do you prefer? If Defcon I required an immediate investment of $25,000 of working capital, would your answer change? Present Answers in Excel Formula

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts