Question: (a) You are provided with the annual return, standard deviation of returns and tracking error to the relevant benchmark for three portfolios. Calculate the Sharpe

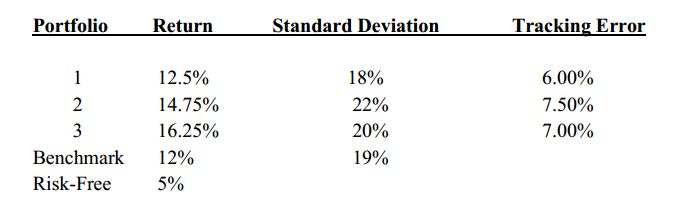

(a) You are provided with the annual return, standard deviation of returns and tracking error to the relevant benchmark for three portfolios. Calculate the Sharpe Ratio and Information Ratio for the three portfolios and rank them according to each measure.

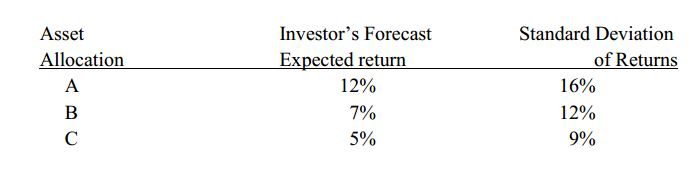

(b) Jimmy Phua is a Fund Manager with a Singapore domiciled fund and is evaluating the following assets for investment:

(i) If Jimmys risk aversion (RA) is 4. Recommend an asset allocation for him. (ii) A separate Foundation would like to choose an asset allocation from the above assets that minimises the probability of returns below its annual spending rate of 2.5 per cent. Recommend an asset allocation for the Foundation. (iii) Richard van den berg needs to spend 4 per cent from his portfolio annually. He anticipates that the inflation would be 2.0 per cent annually. Richard incurs 65 basis points a year investing his portfolio. Which asset allocation/s satisfies Richards return requirements?

Portfolio Return 12.5% 14.75% 16.25% Benchmark 12% Risk-Free Standard Deviation 18% 22% 20% 19% Tracking Error 6.00% 7.50% 7.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts