Question: a. You have a client who is interested in purchasing fixed income securities with high interest rate risk. Unfortunately, all you have available on your

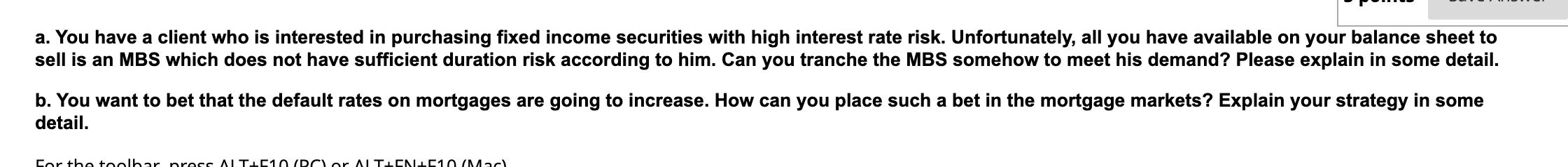

a. You have a client who is interested in purchasing fixed income securities with high interest rate risk. Unfortunately, all you have available on your balance sheet to sell is an MBS which does not have sufficient duration risk according to him. Can you tranche the MBS somehow to meet his demand? Please explain in some detail. b. You want to bet that the default rates on mortgages are going to increase. How can you place such a bet in the mortgage markets? Explain your strategy in some detail. Cor the toolbar ross ATC10 DCar ATEN.C10 Mac

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock