Question: (a) You have been recently appointed as the technical manager of Quality Consultancy Service (QCS). QCS provides training and consultancy advice to companies which

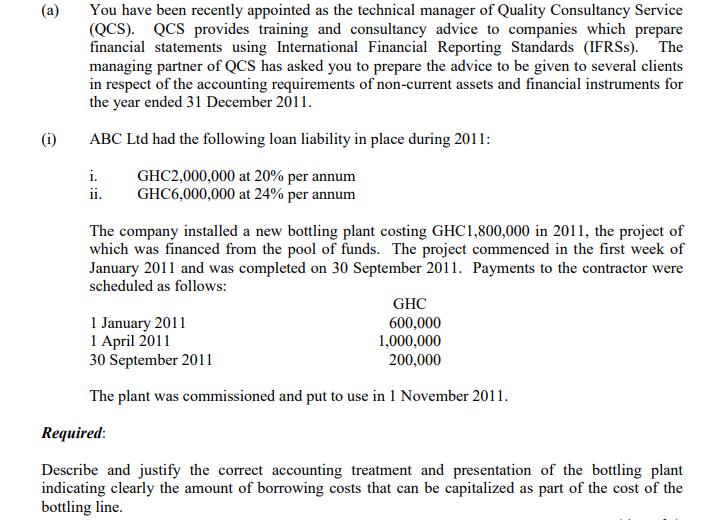

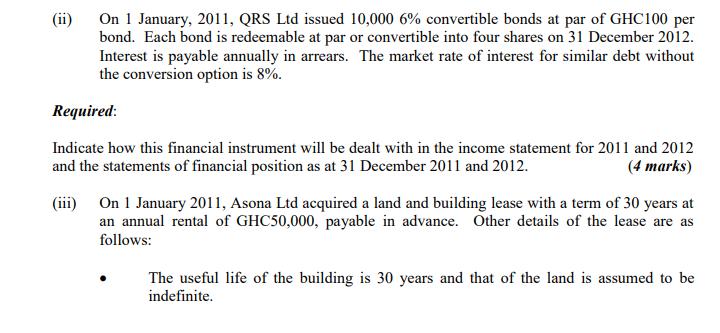

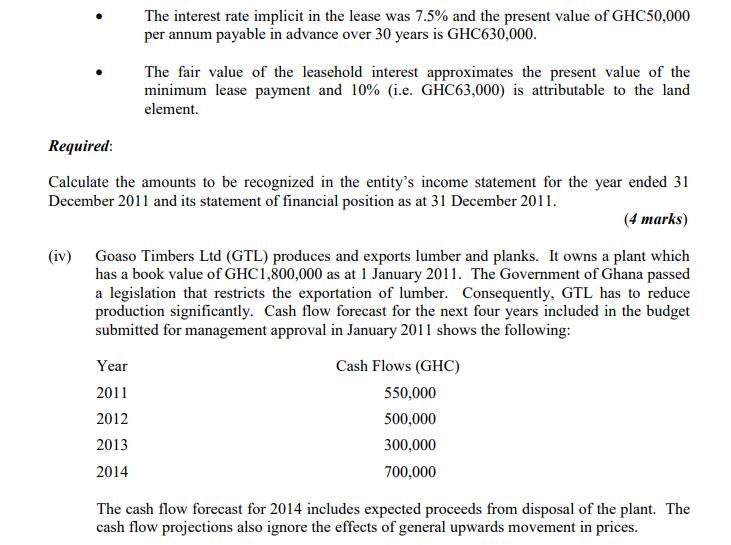

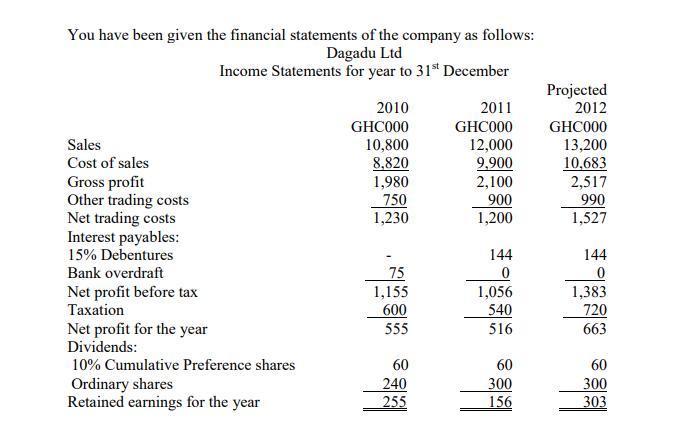

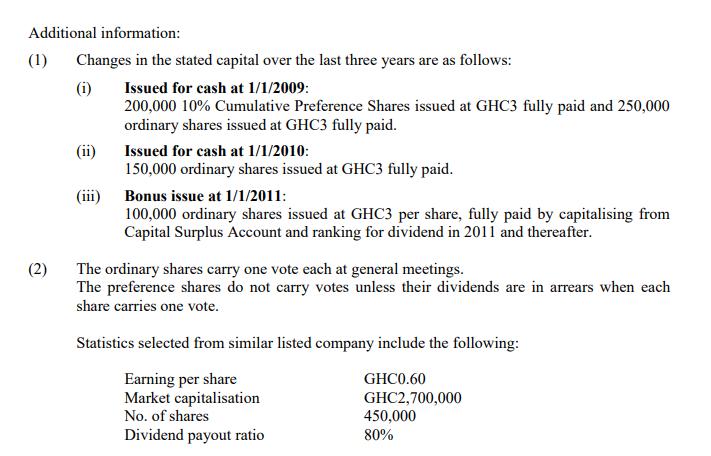

(a) You have been recently appointed as the technical manager of Quality Consultancy Service (QCS). QCS provides training and consultancy advice to companies which prepare financial statements using International Financial Reporting Standards (IFRSs). The managing partner of QCS has asked you to prepare the advice to be given to several clients in respect of the accounting requirements of non-current assets and financial instruments for the year ended 31 December 2011. ABC Ltd had the following loan liability in place during 2011: GHC2,000,000 at 20% per annum GHC6,000,000 at 24% per annum i. ii. The company installed a new bottling plant costing GHC1,800,000 in 2011, the project of which was financed from the pool of funds. The project commenced in the first week of January 2011 and was completed on 30 September 2011. Payments to the contractor were scheduled as follows: GHC 600,000 1,000,000 200,000 1 January 2011 1 April 2011 30 September 2011 The plant was commissioned and put to use in 1 November 2011. Required: Describe and justify the correct accounting treatment and presentation of the bottling plant indicating clearly the amount of borrowing costs that can be capitalized as part of the cost of the bottling line. (ii) On 1 January, 2011, QRS Ltd issued 10,000 6% convertible bonds at par of GHC100 per bond. Each bond is redeemable at par or convertible into four shares on 31 December 2012. Interest is payable annually in arrears. The market rate of interest for similar debt without the conversion option is 8%. Required: Indicate how this financial instrument will be dealt with in the income statement for 2011 and 2012 and the statements of financial position as at 31 December 2011 and 2012. (4 marks) (iii) On 1 January 2011, Asona Ltd acquired a land and building lease with a term of 30 years at an annual rental of GHC50,000, payable in advance. Other details of the lease are as follows: The useful life of the building is 30 years and that of the land is assumed to be indefinite. The interest rate implicit in the lease was 7.5% and the present value of GHC50,000 per annum payable in advance over 30 years is GHC630,000. The fair value of the leasehold interest approximates the present value of the minimum lease payment and 10% (i.e. GHC63,000) is attributable to the land element. Required: Calculate the amounts to be recognized in the entity's income statement for the year ended 31 December 2011 and its statement of financial position as at 31 December 2011. Year 2011 2012 2013 2014 (4 marks) (iv) Goaso Timbers Ltd (GTL) produces and exports lumber and planks. It owns a plant which has a book value of GHC1,800,000 as at 1 January 2011. The Government of Ghana passed a legislation that restricts the exportation of lumber. Consequently, GTL has to reduce production significantly. Cash flow forecast for the next four years included in the budget submitted for management approval in January 2011 shows the following: Cash Flows (GHC) 550,000 500,000 300,000 700,000 The cash flow forecast for 2014 includes expected proceeds from disposal of the plant. The cash flow projections also ignore the effects of general upwards movement in prices. The cash flow forecast for 2014 includes expected proceeds from disposal of the plant. The cash flow projections also ignore the effects of general upwards movement in prices. (b) It is estimated that if the plant is sold in January 2011, it would realize a net proceeds of GHC1,320,000. The costs of capital for GTL is 15% (ignoring inflationary effect). Required: Calculate the recoverable amount of the plant and impairment loss (if any). (4 marks) Dagadu Ltd is an unlisted private company, which deals in computer and other ICT equipment. On 1st March, 2012, a shareholder-director, Mr Kusi, informed you that he was contemplating disposing of his shares. The regulations of the company require him to offer his shares first to his fellow shareholders. If none offers a reasonable price, he may seek an outside purchaser. You have been given the financial statements of the company as follows: Dagadu Ltd Income Statements for year to 31st December Sales Cost of sales Gross profit Other trading costs Net trading costs Interest payables: 15% Debentures Bank overdraft Net profit before tax Taxation Net profit for the year Dividends: 10% Cumulative Preference shares Ordinary shares Retained earnings for the year 2010 GHC000 10,800 8,820 1,980 750 1,230 75 1,155 600 555 60 240 255 2011 GHC000 12,000 9,900 2,100 900 1,200 144 0 1,056 540 516 60 300 156 Projected 2012 GHC000 13,200 10,683 2,517 990 1,527 144 0 1,383 720 663 60 300 303 The statements of financial position as at the end of corresponding years and projected statement for 2012 are as follows: Non-current assets Current assets Current liabilities Net current assets Net assets Financed by: 10% Cumulative Preference shares issued @ GHC3 Ordinary shares Capital surplus Income surplus 15% Debenture (redeemable 2016) Deferred taxation 2010 GHC000 2,115 2,982 (1,344) 1,638 3.753 600 1,200 900 1,032 3,732 1 21 3.753 2011 GHC000 2,220 3,609 (840) 2.769 4.989 600 1,500 600 1,248 3,948 750 291 4.989 Projected 2012 GHC000 3,135 4,206 (1,365) 2,481 5.976 600 1,500 600 2,226 4,926 750 300 5.976 Additional information: (1) Changes in the stated capital over the last three years are as follows: (i) Issued for cash at 1/1/2009: 200,000 10% Cumulative Preference Shares issued at GHC3 fully paid and 250,000 ordinary shares issued at GHC3 fully paid. (2) (ii) (iii) Issued for cash at 1/1/2010: 150,000 ordinary shares issued at GHC3 fully paid. Bonus issue at 1/1/2011: 100,000 ordinary shares issued at GHC3 per share, fully paid by capitalising from Capital Surplus Account and ranking for dividend in 2011 and thereafter. The ordinary shares carry one vote each at general meetings. The preference shares do not carry votes unless their dividends are in arrears when each share carries one vote. Statistics selected from similar listed company include the following: Earning per share GHC0.60 GHC2,700,000 Market capitalisation No. of shares Dividend payout ratio 450,000 80% Assume that investment in unlisted entity is 20% more risky than investment in quoted securities. Required: (i) (ii) Estimate the range of prices per share that Mr Kusi can reasonably expect to realise from the sale of his 50,000 ordinary shares to his fellow shareholders using the following methods: i. Dividend Yield ii. Earnings Yield iii. Net Assets (12 marks) Estimate the highest price per share that he can reasonably obtain from an outside purchaser. (2 marks)

Step by Step Solution

3.53 Rating (167 Votes )

There are 3 Steps involved in it

IAS 1 Presentation of Financial Statements sets out the overall requirements for financial statements including how they should be structured the minimum requirements for their content and overriding ... View full answer

Get step-by-step solutions from verified subject matter experts