Question: a) You purchase a corporate bond with a face value of $10,000, a coupon rate of 8% and a maturity of 6 years. Bonds

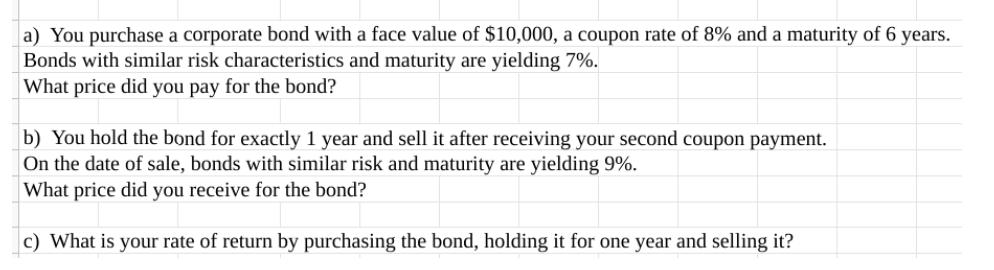

a) You purchase a corporate bond with a face value of $10,000, a coupon rate of 8% and a maturity of 6 years. Bonds with similar risk characteristics and maturity are yielding 7%. What price did you pay for the bond? b) You hold the bond for exactly 1 year and sell it after receiving your second coupon payment. On the date of sale, bonds with similar risk and maturity are yielding 9%. What price did you receive for the bond? c) What is your rate of return by purchasing the bond, holding it for one year and selling it?

Step by Step Solution

3.27 Rating (153 Votes )

There are 3 Steps involved in it

a To calculate the price paid for the bond we can use the following formula Price Coupon payment x 1 ... View full answer

Get step-by-step solutions from verified subject matter experts