Question: A young couple decide to take advantage the current first-time home buyer credit and buy a new house. With their combined income, they can afford

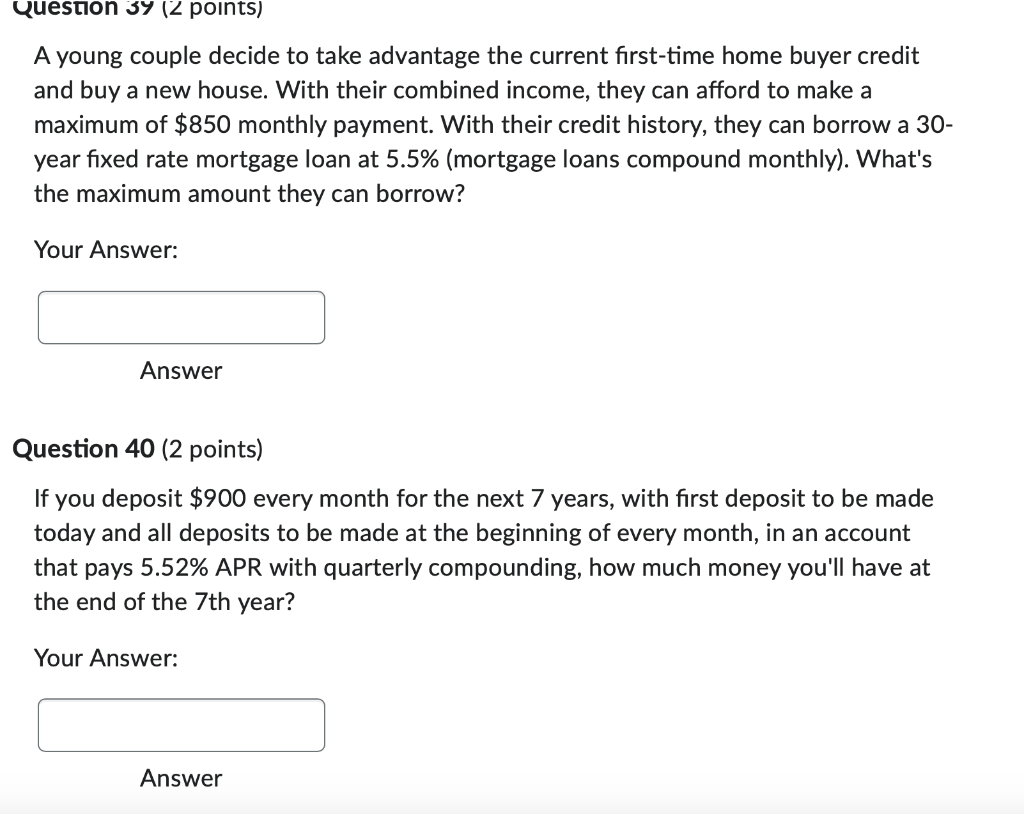

A young couple decide to take advantage the current first-time home buyer credit and buy a new house. With their combined income, they can afford to make a maximum of $850 monthly payment. With their credit history, they can borrow a 30year fixed rate mortgage loan at 5.5% (mortgage loans compound monthly). What's the maximum amount they can borrow? Your Answer: Answer Question 40 (2 points) If you deposit $900 every month for the next 7 years, with first deposit to be made today and all deposits to be made at the beginning of every month, in an account that pays 5.52% APR with quarterly compounding, how much money you'll have at the end of the 7th year? Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts