Question: (a) Your answer is partially correct. Try again. Nash Co. sells $461,000 of 8% bonds on March 1, 2017. The bonds pay interest on September

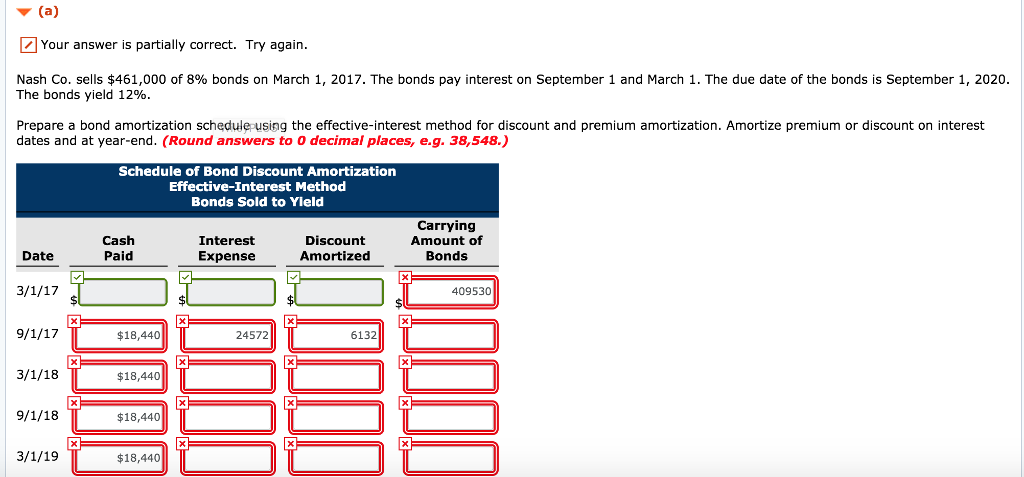

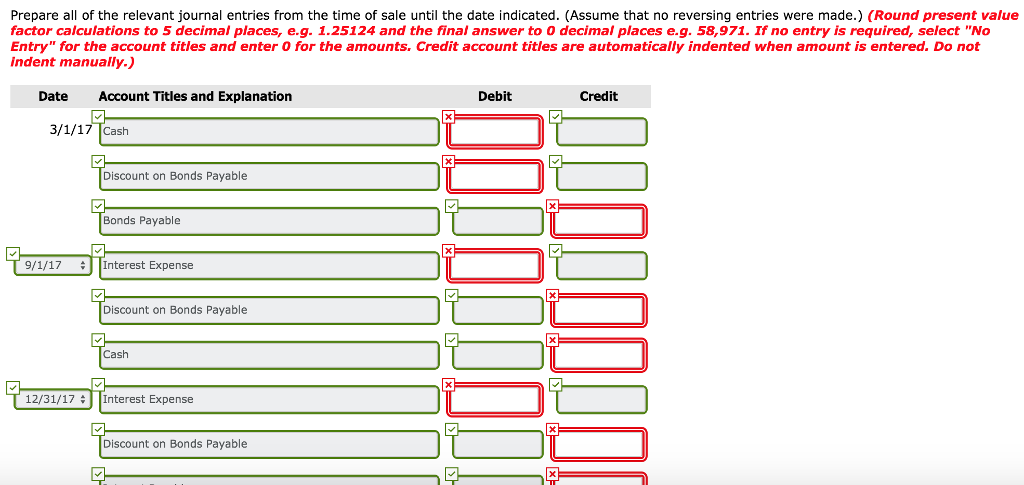

(a) Your answer is partially correct. Try again. Nash Co. sells $461,000 of 8% bonds on March 1, 2017. The bonds pay interest on September 1 and March 1, The due date of the bonds is September 1, 2020 The bonds yield 12% Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year-end. (Round answers to 0 decimal places, e.g. 38,548.) Schedule of Bond Discount Amortization Effective-Interest Method Bonds Sold to Yield Cash Paid Interest Expense Discount Amortized Carrying Amount of Bonds Date 409530 $18,440 24572 6132 $18,440 $18,440 $18,440

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts