Question: A zero coupon bond will be worth $8,000 when it matures and is redeemed after 8 years. How much would an inventor be willing to

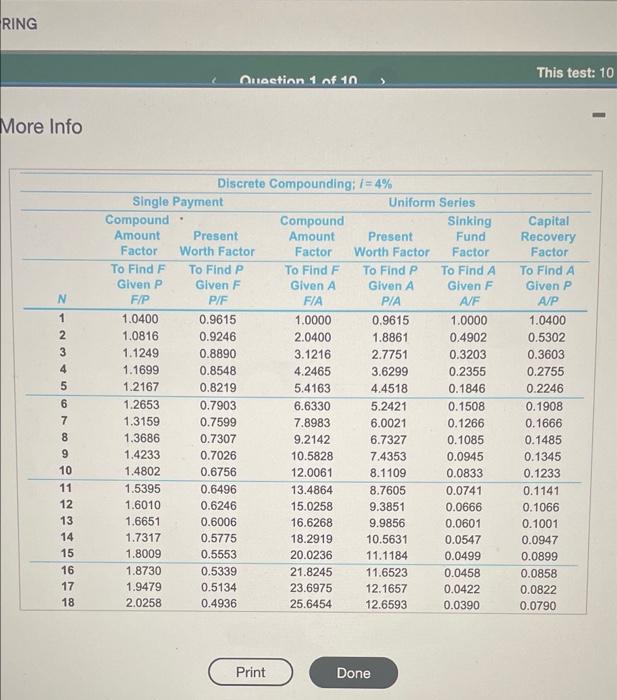

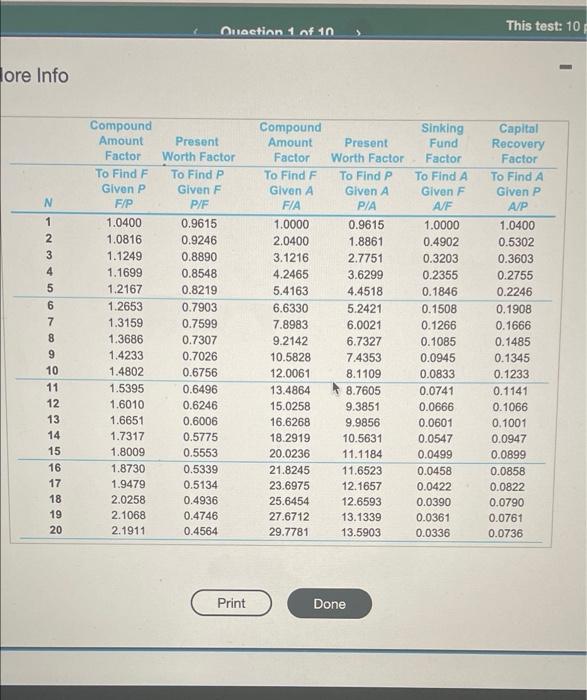

A zero coupon bond will be worth $8,000 when it matures and is redeemed after 8 years. How much would an inventor be willing to pay now for this bond if a 4% per year yield in desired? Click the icon to view the interest and annuty table for discrete compounding when % per year. CHE The current worth of the bond is #Pound to the nearest dolar) RING This test: 10 Queetinn 1 of 10 More Info 2 1 2 500 AWN 5 6 7 8 Discrete Compounding;/=4% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Glven F Given A Given A Glven F F/P P/F FIA PIA A/F 1.0400 0.9615 1.0000 0.9615 1.0000 1.0816 0.9246 2.0400 1.8861 0.4902 1.1249 0.8890 3.1216 2.7751 0.3203 1.1699 0.8548 4.2465 3.6299 0.2355 1.2167 0.8219 5.4163 4.4518 0.1846 1.2653 0.7903 6.6330 5.2421 0.1508 1.3159 0.7599 7.8983 6.0021 0.1266 1.3686 0.7307 9.2142 6.7327 0.1085 1.4233 0.7026 10.5828 7.4353 0.0945 1.4802 0.6756 12.0061 8.1109 0.0833 1.5395 0.6496 13.4864 8.7605 0.0741 1.6010 0.6246 15.0258 9.3851 0.0666 1.6651 0.6006 16.6268 9.9856 0.0601 1.7317 0.5775 18.2919 10.5631 0.0547 1.8009 0.5553 20.0236 11.1184 0.0499 1.8730 0.5339 21.8245 11.6523 0.0458 1.9479 0.5134 23.6975 12.1657 0.0422 2.0258 0.4936 25.6454 12.6593 0.0390 Capital Recovery Factor To Find A Given P A/P 1.0400 0.5302 0.3603 0.2755 0.2246 0.1908 0.1666 0.1485 0.1345 0.1233 0.1141 0.1066 0.1001 0.0947 0.0899 0.0858 0.0822 0.0790 10 11 12 13 14 15 16 17 18 Print Done Ouaction 1 of 1n This test: 10 ore Info N 1 2 Z NON 4 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Compound Amount Factor To Find F Given P F/P 1.0400 1.0816 1.1249 1.1699 1.2167 1.2653 1.3159 1.3686 1.4233 1.4802 1.5395 1.6010 1.6651 1.7317 1.8009 1.8730 1.9479 2.0258 2.1068 2.1911 Present Worth Factor To Find P Given F P/F 0.9615 0.9246 0.8890 0.8548 0.8219 0.7903 0.7599 0.7307 0.7026 0.6756 0.6496 0.6246 0.6006 0.5775 0.5553 0.5339 0.5134 0.4936 0.4746 0.4564 Compound Amount Factor To Find F Given A FIA 1.0000 2.0400 3.1216 4.2465 5.4163 6.6330 7.8983 9.2142 10.5828 12.0061 13.4864 15.0258 16.6268 18.2919 20.0236 21.8245 23.6975 25.6454 27.6712 29.7781 Present Worth Factor To Find P Given A P/A 0.9615 1.8861 2.7751 3.6299 4.4518 5.2421 6.0021 6.7327 7.4353 8.1109 8.7605 9.3851 9.9856 10.5631 11.1184 11.6523 12.1657 12.6593 13.1339 13.5903 Sinking Fund Factor To Find a Given F A/F 1.0000 0.4902 0.3203 0.2355 0.1846 0.1508 0.1266 0.1085 0.0945 0.0833 0.0741 0.0666 0.0601 0.0547 0.0499 0.0458 0.0422 0.0390 0.0361 0.0336 Capital Recovery Factor To Find a Given P A/P 1.0400 0.5302 0.3603 0.2755 0.2246 0.1908 0.1666 0.1485 0.1345 0.1233 0.1141 0.1066 0.1001 0.0947 0.0899 0.0858 0.0822 0.0790 0.0761 0.0736 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts