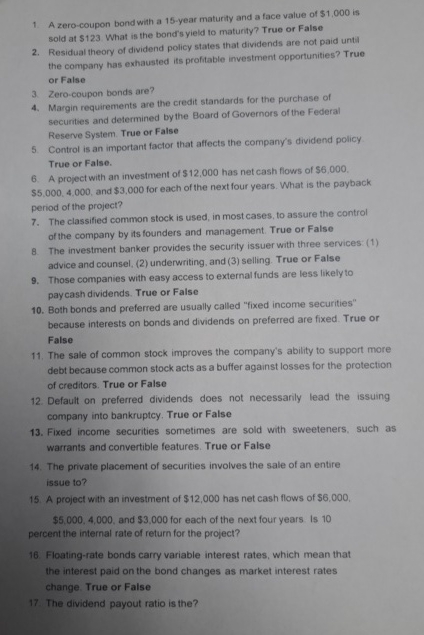

Question: A zero - coupon bond with a 1 5 - year maturity and a face value of $ 1 , 0 0 0 is sold

A zerocoupon bond with a year maturity and a face value of $ is sold at $ What is the bond's yield to maturity? True or False

Residual theory of dividend policy states that dividends are not paid unt: the company has exhausted its profitable investment opportunities? True or False

Zerocoupon bonds are?

Margin requirements are the credit standards for the purchase of securities and determined by the Board of Governors of the Federal Reserve System. True or False

Control is an important factor that affects the company's dividend policy True or False.

A project with an investment of $ has net cash flows of $

$ and $ for each of the next four years. What is the payback period of the project?

The classified common stock is used, in most cases, to assure the control of the company by its founders and management. True or False

The investment banker provides the security issuer with three services: advice and counsel, underwriting, and selling. True or False

Those companies with easy access to external funds are less likely to paycash dividends. True or False

Both bonds and preferred are usually called "fixed income securities because interests on bonds and dividends on preferred are fixed. True or False

The sale of common stock improves the company's ability to support more debt because common stock acts as a buffer against losses for the protection of creditors. True or False

Defaut on preferred dividends does not necessarily lead the issuing company into bankruptcy. True or False

Fixed income securities sometimes are sold with sweeteners, such as warrants and convertible features. True or False

The private placement of securities involves the sale of an entire issue to

A project with an investment of $ has net cash flows of $

$ and $ for each of the next four years is percent the internal rate of return for the project?

Floatingrate bonds carry variable interest rates, which mean that the interest paid on the bond changes as market interest rates change. True or False

The dividend payout ratic is the?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock