Question: A zero-coupon Treasury security (that is, a T-bill) has 50 days to maturity and a discount yield of 4.2%. Calculate the effective yield for

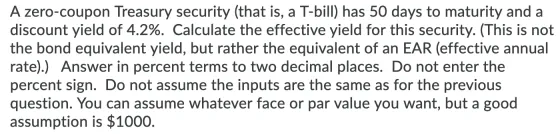

A zero-coupon Treasury security (that is, a T-bill) has 50 days to maturity and a discount yield of 4.2%. Calculate the effective yield for this security. (This is not the bond equivalent yield, but rather the equivalent of an EAR (effective annual rate).) Answer in percent terms to two decimal places. Do not enter the percent sign. Do not assume the inputs are the same as for the previous question. You can assume whatever face or par value you want, but a good assumption is $1000.

Step by Step Solution

There are 3 Steps involved in it

Heres how to calculate the effective yield for the zer... View full answer

Get step-by-step solutions from verified subject matter experts