Question: A1 A B D E F G 2 fx Using the Module 6 spreadsheet template as a model, you are going to first replicate the

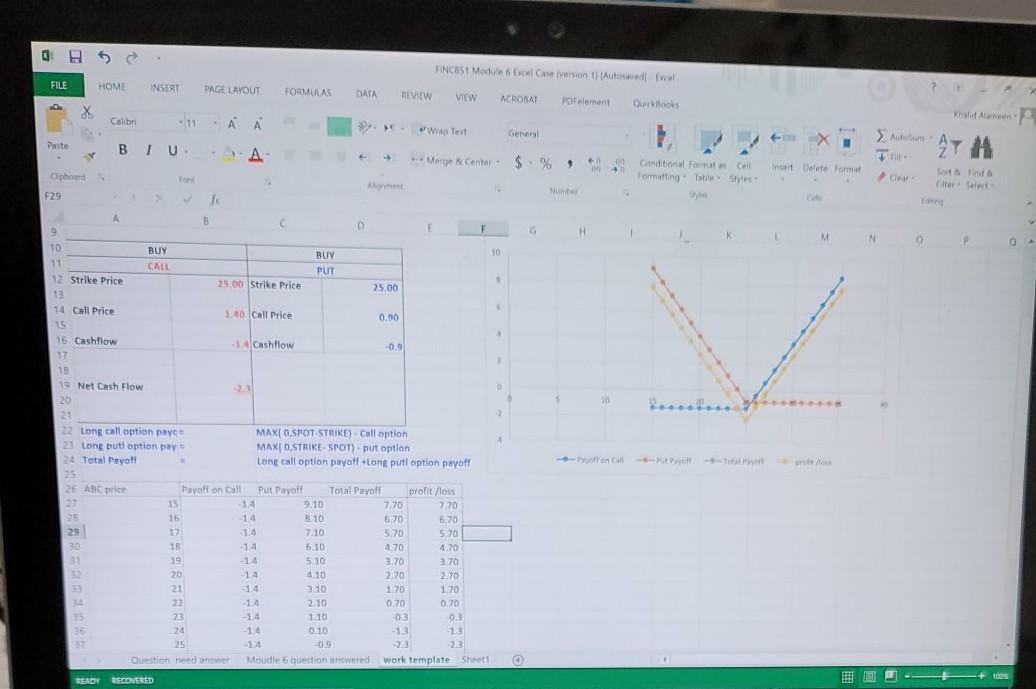

A1 A B D E F G 2 fx Using the Module 6 spreadsheet template as a model, you are going to first replicate the risk manageme H 1 1 Using the Module 6 spreadsheet template as a model, you are going to first replicate the risk management strategy of using futures contracts to hedge aluminum prices. Next, create a risk management strategy if you had the opposite natural position in aluminum (in other words, an 5 inflow). What would your natural position look like? What type of futures contract would hedge this 6 risk? Finally, what would the combined payoff look like? Adjust the spreadsheet for this strategy. 3 4 7 8 9 10 11 12 41 A B C D E F G H 1 2 3 5 You are going to apply a very popular investment strategy with options called a straddle Basically, you buy a call option and a po K M N You are going to apply a very popular investment strategy with options called a straddle. Basically, you buy a call option and a put option for the same stock and the same maturity that are as close as possible to being at the money (stock and strike price very close to each other). First, use the information given in the spreadsheet to create the payoffs in dollars. The payoff diagram will fill in as you put in payoffs. Second, go out and choose a stock of your choice that has options traded on it and replicate a straddle strategy with real data. Yahoo Finance has easily accessible option data for stocks and can be viewed in straddle view. What conclusions can you draw from this type of strategy in terms of upside and downside as well as when do you gain and when do you lose? D 11 12 13 14 15 17 05 FINC851 Module cale version 11 towed wat FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW ACROBAT Porelement Oook Alam Calib 11 A A 'Wap Tovt General Paste BIU NA Mary & Centar $ % . 00 Conditional Format Call Formatting Table Style Incart Delete Format Opto att alert Ant F29 Net B F H K M N BUY 10 PUT 25:00 Strike Price 25.00 9 10 BUY 11 CALL 12 Strike Price 13 14 Call Price 15 16 Cashflow 17 18 19 Net Cash Flow 20 1.40 Call Price 0.00 1 Cashflow -0.9 Uro 2 Long call option pay MAX SPOT STRIKE) - Call option 23 Long putl option pay MAXI STRIKE SPOT) put option 24 Total Payott Lone call option payoff Lone pull option payoff 25 25 AC price Payot on call Put Payati Total Payoff profit loss 15 1.4 9:10 7.70 7.70 25 16 14 8.10 6,70 6.70 29 17 1.4 710 5.70 5,70 IB -14 610 4.70 4.70 19 5.10 3.70 3.70 20 -14 4.10 2.70 2.70 21 2 10 170 1.70 22 14 2.10 0.70 0.70 23 -14 1.10 -03 03 24 -1.4 0.10 -12 13 25 -14 09 23 23 Questiot need anwer Moudles question answered work template Sheet READY RECOVERED + IDE A1 A B D E F G 2 fx Using the Module 6 spreadsheet template as a model, you are going to first replicate the risk manageme H 1 1 Using the Module 6 spreadsheet template as a model, you are going to first replicate the risk management strategy of using futures contracts to hedge aluminum prices. Next, create a risk management strategy if you had the opposite natural position in aluminum (in other words, an 5 inflow). What would your natural position look like? What type of futures contract would hedge this 6 risk? Finally, what would the combined payoff look like? Adjust the spreadsheet for this strategy. 3 4 7 8 9 10 11 12 41 A B C D E F G H 1 2 3 5 You are going to apply a very popular investment strategy with options called a straddle Basically, you buy a call option and a po K M N You are going to apply a very popular investment strategy with options called a straddle. Basically, you buy a call option and a put option for the same stock and the same maturity that are as close as possible to being at the money (stock and strike price very close to each other). First, use the information given in the spreadsheet to create the payoffs in dollars. The payoff diagram will fill in as you put in payoffs. Second, go out and choose a stock of your choice that has options traded on it and replicate a straddle strategy with real data. Yahoo Finance has easily accessible option data for stocks and can be viewed in straddle view. What conclusions can you draw from this type of strategy in terms of upside and downside as well as when do you gain and when do you lose? D 11 12 13 14 15 17 05 FINC851 Module cale version 11 towed wat FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW ACROBAT Porelement Oook Alam Calib 11 A A 'Wap Tovt General Paste BIU NA Mary & Centar $ % . 00 Conditional Format Call Formatting Table Style Incart Delete Format Opto att alert Ant F29 Net B F H K M N BUY 10 PUT 25:00 Strike Price 25.00 9 10 BUY 11 CALL 12 Strike Price 13 14 Call Price 15 16 Cashflow 17 18 19 Net Cash Flow 20 1.40 Call Price 0.00 1 Cashflow -0.9 Uro 2 Long call option pay MAX SPOT STRIKE) - Call option 23 Long putl option pay MAXI STRIKE SPOT) put option 24 Total Payott Lone call option payoff Lone pull option payoff 25 25 AC price Payot on call Put Payati Total Payoff profit loss 15 1.4 9:10 7.70 7.70 25 16 14 8.10 6,70 6.70 29 17 1.4 710 5.70 5,70 IB -14 610 4.70 4.70 19 5.10 3.70 3.70 20 -14 4.10 2.70 2.70 21 2 10 170 1.70 22 14 2.10 0.70 0.70 23 -14 1.10 -03 03 24 -1.4 0.10 -12 13 25 -14 09 23 23 Questiot need anwer Moudles question answered work template Sheet READY RECOVERED + IDE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts